A hurricane could be coming.

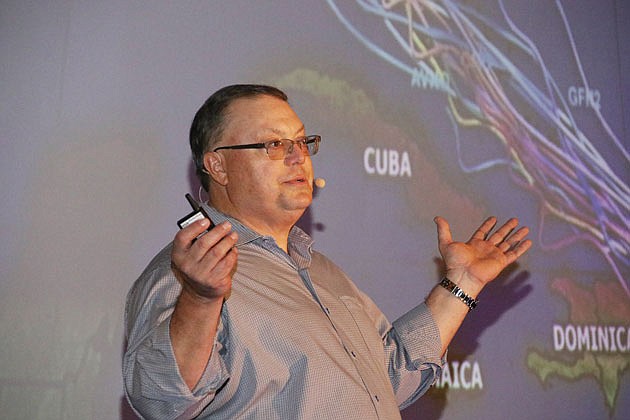

That was the analogy Land Solutions Inc. CEO Randy Thibaut used in describing potential trouble for the real estate industry in 2018 in Charlotte, Lee and Collier counties.

“This market is in many ways very similar to a hurricane headed our way,” says Thibaut, who formed commercial real estate brokerage firm Land Solutions in 2001 and has hosted an annual “Market Trends” event each year since 2010. “There are things you need to watch out for, or you're going to get slammed.

“Statistics and the natural order of things tells us we have to be careful.”

Thibaut notes that 2017 marks the eighth year of economic recovery in the U.S., a pattern that historically lasts between four and seven years before growth slides into recession.

“We can't ignore that,” he says. “Statistically, it means we're now on some borrowed time.”

Interest rate hikes seemingly on the horizon also could impact home and other sales in Southwest Florida and beyond, he contends, because each 50 basis point jump in interest rates impacts buyers' residential affordability.

“The bulk of the market here could be affected,” he says.

At the same time, a renewed nationwide trend toward home equity borrowing -- up to $42 billion now versus $100 billion in 2007 — could foreshadow that borrowers are taking future home appreciation for granted, leaving many potentially at risk for default.

Thibaut also considers so-called “teaser” interest rates — intended to spur buyers into action — to be dangerous, as they could lead to waves of defaults in the years ahead.

“What happens when the interest rates go up? Well, you have a potentially huge supply of homes that come on the market or that are foreclosed on,” Thibaut says. “Right now, it's all about the monthly (mortgage) payment.”

Impact fees, already considerable in some areas, could also further limit buyers' ability to purchase a home in 2018 if potential increases take effect. Lee County, for instance, is considering a proposal to tack on $7,000 in impact fees to offset costs for services, schools and common infrastructure.

In Collier County, Thibaut says onerous residential impact fees “are the same as the price of a new car” for each new home.

Then there's the impact of an actual hurricane. Hurricane Irma, which devastated parts of Southwest Florida when it struck in September, will cause ripples throughout the three-county real estate well into 2018.

“It was a big deal,” Thibaut says, noting the hurricane drove up prices for labor and construction commodities already pushing recovery-era peaks. “And it's going to last for awhile yet.”

Despite the potential storm clouds, Thibaut believes the market will remain healthy for the foreseeable future, especially in the northern and eastern areas of Collier and Lee counties, such as Lehigh Acres, Ave Maria, Cape Coral and Babcock Ranch, the master-planned community that bisects Charlotte and Lee counties.

There, value-oriented buyers ranging from retirees to millennials who are chasing affordability are driving high double-digit gains in building permit activity.

Lehigh Acres, for instance, experienced growth of 62% in permits pulled year-over-year from October 2016 to September, Thibaut says.

“Homes under $300,000 are on fire, and that's where they're being built,” he says. “Value-conscious buyers are out there.”

At the same time, luxury condominium towers either under construction or planned in Naples and elsewhere have maintained traction with upscale buyers.

Mystique, an 81-unit tower being developed by Gulf Bay Group of Cos. in Naples with prices ranging from $1.2 million to $10 million, is now 35% committed.

Aqua II, from Ironshore Capital Partners, is 84% sold. Ronto Group's Seaglass at Bonita Bay has 63% of its units spoken for, and Lennar Corp.'s Altaira project is 51% sold out.

“Clearly in Naples, especially, there's a burning desire for new luxury product,” Thibaut says.

Overall, Land Solutions projects there will be roughly 13,000 new building permits issued in Charlotte, Collier and Lee counties in 2017, a roughly 21% percent hike from 2016.

Those figures compare to the roughly 2,000 permits pulled in recession-laden 2009 and the 44,000 permits issued in the frenzy that was 2005.

Additionally, median home prices in the third quarter of this year hit a 10-year high, a sign of a continuing waxing market, and multifamily rental and senior housing development activity have regained 2015 momentum, Land Solutions' 3rd Quarter Market trends report states.

Going forward, the firm forecasts that new residential permits and home prices overall will be flat throughout 2018.

Thibaut acknowledges, of course, that his prediction of a coming storm could be off. Between October 2016 and September, for instance, he believed Lee County permit activity would be flat.

Instead, it jumped 33%, largely on the strength of new apartment complexes and assisted living facilities.

“We totally didn't expect that to happen,” he says.