What is the cost of the federal regulatory environment for small businesses and the overall American business sector?

It is expensive and the mountains of new regulations created during the Obama administration impeded the economic growth of our great nation.

Our country needs regulations and no one (including me) is calling for zero regulations. But, there comes a tipping point where the burden is just so taxing that it hurts economic growth. Case in point was made by the Obama administration that the over-regulation of the American economy stunted and prevented robust economic growth. That will go down as a textbook example to future presidents as what NOT to do.

Since President Trump’s inauguration in January 2017, the U.S. has experienced significant economic growth that leads the free world. That credit needs to be given to the president for setting the agenda in cutting unnecessary regulatory burdens on businesses and to Congress for enacting laws to cut and reduce the regulatory burden.

For instance, 17 Senate and 33 House Democrats joined Republicans to enact S.2155 – The Economic Growth, Regulatory Relief, and Consumer Protection Act. While this bill does not undo Dodd-Frank, it will certainly help community and midsize banks better meet the needs of their customers.

A Florida banker, Lloyd DeVaux, said it best last summer in testimony before Congress : “For every $100,000 bankers spend on compliance, it is $1 million less a bank can lend in the community.” This new law will help redeploy some of the resources previously dedicated to compliance costs back to helping Americans fulfill their dreams of buying a home, sending a child to college or starting a small business.

A January 2017 Forbes article entitled “The $83,000 Question: How Much Do Regulations Really Cost Small Businesses?” noted that it costs a small business more than $83,000 in its first year to comply with the federal regulatory mountain of rules and regulations; future costs for each small business are approximately $12,000 annually. That is big money for the heart and soul of America’s economy — small businesses. These figures come from the first-ever Small Business Regulations Survey conducted by the National Small Business Association.

The National Association of Manufacturers says the cost of federal regulations in 2012 was $2.028 trillion (in 2014 dollars). The annual cost burden for an average U.S. firm is $233,182, or 21% of average payroll. I would rather see more employees hired who produce and manufacture than nonproductive compliance staff.

Unemployment is at record lows for just about every category, and that is no coincidence. We finally have a president who, like Presidents Kennedy and Reagan, understands the impact of supporting a tax cut to aid the nation’s economy and each American family.

The economy has created nearly 3 million jobs since January 2017. The unemployment rate is now at 3.8%, a record low, matching its lowest level in nearly 50 years. Consumer confidence and business optimism continue to increase. We cannot let these statistics lull us to sleep; we must remain vigilant against an economic downturn by continuing to be smart as individuals on the use of credit and U.S. companies must keep close tabs on inventory and not overbuild — two factors that heavily contributed to the 2008 economic slide.

President Trump realized that America had the highest business tax of any of the G-20 countries in the world. Our country was simply not competitive on the world stage and he pushed for passage of the tax reform bill late last year. After that bill became law, many American companies announced it would bring back monies deposited overseas to work again in our country. Apple, for instance, repatriated more than $250 billion it had overseas to reinvest in America.

I am excited that our community and midsize banks are in a better position today to strive and compete than we have been in a decade. The change in Washington, D.C. is by no means creating a regulation-free economy, just one that allows our community midsized banks to focus more on enhancing the economic vitality of the persons and communities they serve. Other industries also share in that sentiment and America once again is back as the economic leader in this global economy.

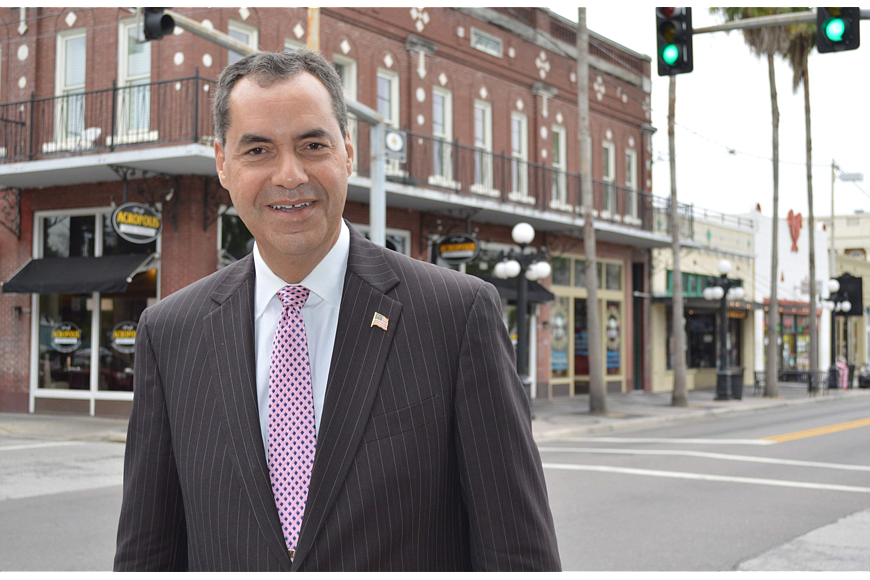

Alex Sanchez is president and CEO of the Florida Bankers Association, which has membership of small, regional and large financial institutions that together employ tens of thousands of Floridians, safeguard more than $500 billion in deposits and extend more than $135 billion in loans.