- July 26, 2024

-

-

Loading

Loading

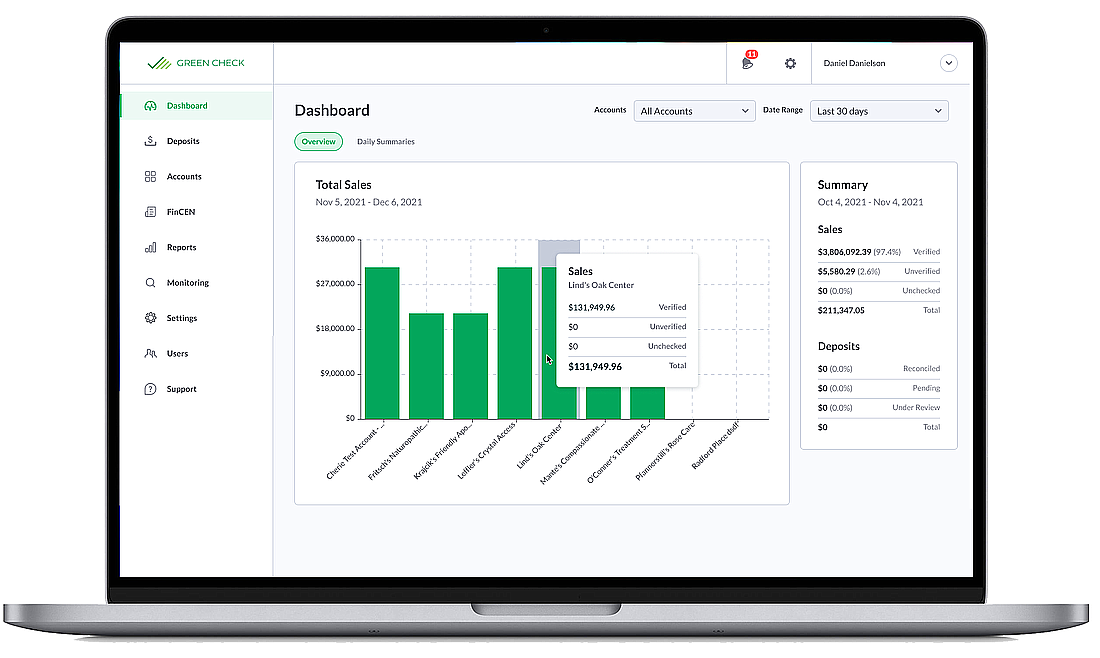

Green Check, a Bonita Springs fintech company focused on the cannabis industry, says it had 131% growth in 2023.

Green Check says it experienced "significant growth with more than 8,800 cannabis businesses now on its industry-leading platform, a 131% increase, with more than $6 billion in sales tracked, a 74% increase.

The company says it also tracked $9 billion in total deposits, a 35% increase across the platform.

"We're invigorated by all that we have accomplished in 2023 to connect legal cannabis operators with financial institutions across the country," says Kevin Hart, CEO and co-founder of Green Check, in a statement. "We look forward to building on our progress, with the acquisitions of PayQwick and Komplyd, and remain staunchly committed to equipping banks, credit unions and cannabis-related businesses with the financial tools they need to contribute to their communities at their highest potential."

Green Check says it started 2023 with a $6 million Series A investment round led by Mendon Venture Partners, which helped Green Check to establish a "holistic financial services ecosystem" for banks, credit unions and cannabis-related businesses.

Green Check acquired Komplyd, a San Jose, California, firm in June. Terms were not disclosed.

Komplyd says it was the first "purpose-built compliance-as-a-service platform designed for business applications targeting the cannabis industry."

Last year, Green Check also debuted a first-of-its-kind cannabis business marketplace, Green Check Connect. The platform offers cannabis businesses "a centralized network of reliable, trustworthy and cost-effective financial and business service providers, all of which have been vetted by Green Check's team of experts," the firm says.

"Since launch, Green Check has tripled its number of marketplace partners, representing the growing number of business services providers dedicated to supporting the cannabis industry," the company says.

Green Check says it expanded its footprint in 2023, joining forces with a number of new banks and credit unions. New partners, serving clients nationwide, include Affinity, New Jersey's largest credit union; Tasi Bank in the Bay Area; Illinois-based Credit Union 1; and Main Street Bank, which serves communities in Massachusetts.