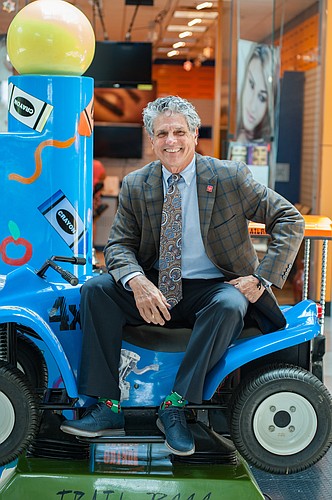

PAUL RUTLEDGE, senior vice president, JLL, Tampa

Paul Rutledge has worked in the retail sector since 1975, when he landed a job promoting shopping mall-based events for developer Edward J. DeBartolo Corp. From there, he did stints in Toronto and Miami, learning the brokerage business and developing Publix Super Markets Inc.-anchored shopping centers, respectively. Eventually, Rutledge moved to New York to work for The Related Group in acquisitions, which, in turn, led to executive-level jobs with developer Casto Southeast Realty Services and brokerage firm CBRE Group. He joined JLL in April of this year, to develop a retail-centric team and focus on business development. Rutledge is also heavily involved with the International Council of Shopping Centers (ICSC). In 2015/2016, he was the group’s Florida operations chairman. Last month he attended and taught at the ICSC’s annual confab in Orlando.

Characterize this year’s Orlando ICSC convention for us.

I’d say it was the best meeting since the recession ended. There was so much enthusiasm, but it wasn’t effervescent, everyone was very practical and pragmatic and reasonable. Land prices and construction prices have gone up considerably, but they haven’t skyrocketed, and people strike me now as more disciplined. It’s a good equilibrium. And the influx of the grocery boom in Florida showed. It seems like everyone there had a deal to work on, a realistic deal, and that’s always good.

How would you compare this year’s conference to, say, a decade ago?

There are a lot more young people now in the business than in 2008. For years since the recession the business was dominated by the old guard, but now there’s new blood and that’s good. And it’s not like it was a decade ago, with people just throwing money around and buying land to try and make a deal work. Today people are very businesslike. I’m not sure whether that’s because of folks’ bankers or because they have bad memories of a decade ago, but today things are metered, and yet there’s lots of work.

What surprised you most about the ICSC confab this year?

What’s surprised me the most is how many people are developing retail deals that aren’t just on the best corners but that they’re integrated into apartments and other uses — that’s a big step forward. Multi-use properties are now very well received, which allows for retail on bigger sites, so there are nuances that we’ve not seen previously.

You were part of a panel discussion at this year’s ICSC meeting, weren’t you? Tell us what that was like.

It was really cool, 20 very interesting people talking about sales, what institutions want and what cap rates are for various properties. There was a lot of discussion about Aldi and Lucky’s and how they’re changing things. I’m biased, Lucky’s is my client, but they really are. There was a lot of discussion about how power centers are now out of favor and how cap rates are anywhere between 5% and 6% and getting more aggressive all the time.

How would you characterize the Florida retail market today?

It’s fantastic. I’m not sure if Florida isn’t the best market in the country right now, in part because of the amount of available land and because construction costs are still rational. You can still buy land for projects in Manatee County, you can still buy land in Sarasota County, permitting fees are not overwhelming, and development in general isn’t as painful as it once was. The whole zoning process is more understandable now, too, as governments have come to realize the benefits of development in general. People today know by the codes what they can build and how much money is will cost. Florida is chock full of growth and stable incomes and jobs — what’s not to like?

You touched on it briefly, but drill down a little bit: What makes the Florida market so good?

Certainly demographics are a large part of it. People have revived downtowns and created new markets in the process. It’s why apartments and retail go together so well. But even outside of downtowns — look at Lakewood Ranch. In 2006, there were 12,000 families there. Now, it’s exploded. There have to be more twice that number, but it’s still a very livable place. Florida has no income tax, so folks from high-tax places like New York and California are coming here, moving here, in droves. And even the boxes that are empty, like those by Toys “R” Us and Winn-Dixie, are turning over and being re-tenanted. And there’s a lot of money in Florida, for investment and shopping. It doesn’t hurt that one million people a week travel to Orlando and Miami.

What do you think about the state of malls in Florida?

In my opinion, here’s the deal with malls: They’re largely functionally obsolete as a single use; you only need one of them where years ago we thought we needed eight. Many of them are old, so they need to be retrofitted. I think the first thing that should happen is developers should put in residential. They typically have plenty of land, where you could do apartments, senior housing, workforce housing, townhomes, or student housing. And that helps with placemaking; I’m a big proponent of adding in public spaces, too, because that, in turn, draws people. And events. What if the mall were the site of the weekly farmer’s market or a local 5K race? So from there, you integrate the retail. It’s no longer the only thing. People looking to buy malls, in my opinion, get confused because they look at the buildings. But what you really need to look at is the infrastructure — the parking, the land, the access, the location. That axiom needs to be turned.

Everyone says the retail apocalypse is here for brick-and-mortar stores, but you seem pretty optimistic.

I don’t hear anyone freaking out about the demise of the retail industry, to be honest. I think people are cognizant that shifts are occurring; you’d have to be naïve not to be. But this idea that brick-and-mortar stores are disappearing is a fallacy. Take delivery: I don’t think everyone can afford to deliver goods on a next-day or same-day basis, there’s just not enough margin to do it. So people will always have to go and pick things up at stores. Consider, too, that online sales, despite all the growth that’s occurred, are 10% of the total retail market. Ten percent, that’s it.

But you have to be more than a little concerned about the proliferation of online sales, right?

I think it comes down to who has the wherewithal to make deals and provide superior customer service and who has the inventory needed to compete. Lucky’s Market has the best prepared foods in the grocery business, and guess what? People are changing their business models, and even their stores, to compete with them and add that type of product.

What concerns you about retail today?

Little stuff, like people who aren’t good at their business and folks who aren’t well capitalized. The electronics industry, I think, has really opened people’s minds up to the expansion of products — I call it the “Shark Tank Effect.” I think I get concerned about what’s happening outside of America and its potential impact on us, from trade wars to labor availability. Less somewhat are concerns about land prices getting out of control and inflation.

You’re not worried about the growth of consumer debt? That seems like shades of 2007.

A lot of people don’t have any money saved, if the surveys are to be believed. I’m concerned about the lack of a strong middle class and what that could do to the economy. You can’t work and go broke.

What about the abundance of grocery stores and restaurants that have sprung up in Florida. Can they co-exist?

Sure. Grocery shopping isn’t the same as it used to be. Nowadays, people want a special kind of coffee or a nice bottle of wine with dinner or organic food. The difference is in where capital is deployed. People aren’t generally buying new cars or clothes at the pace or rate they once did, so they have more money for food purchases or restaurants. If you looked at what most people devote today to food vs. what the average weekly grocery bill was when I was growing up — and I’m 65 — it would be totally different. People have different demands now, different tastes. And they’re willing to sacrifice other things to get them. I bet if people use to spend $100 a week going out to eat or at the grocery store, now they spend $200 a week.