Executive Summary

City. Venice Industry. Development. Key. City's demographics lean older than what national businesses traditionally target.

In September, prolific Lakewood Ranch-based homebuilder Neal Communities sold 84 homes. The Venice market accounted for 29, with 15 homes sold at Neal's Milano community, five at Windwood, and nine at Grand Palm.

In October, Neal sold 100 homes, nine of which were at Milano, three at Windwood, and 11 at Grand Palm. “Venice is a beautiful gem of a community,” says company President and CEO Pat Neal. “And it's now the second-fastest-selling region in our five-county region after Lakewood Ranch.”

Everyone from developers to Midwesterners seems to have finally discovered this city in southern Sarasota County. Previously known for its high median age, Venice is now considered a good spot in which to build thanks to changing demographics and availability of land that costs less than similar parcels to the north in Sarasota or east Manatee County.

“When we started doing commercial work in the Venice market 10 to 12 years ago, we had a difficult time attracting attention from national retailers,” says Loyd Robbins, vice president at Harry E. Robbins Associates Inc. in Sarasota. “About a year and a half ago, people woke up and realized there were great opportunities in Venice.”

Lay of the land

The city of Venice is home to about 22,000 people in 16.64 square miles. Originally developed by famed city planner John Nolen, it encompasses the entire “island” of Venice (created by the construction of the Intracoastal Waterway). Its boundaries then stretch east down Venice Avenue to Auburn Road and northeast to the North Venice area along Laurel Road near Interstate 75, which was annexed in the 2000s.

The rest of what's known as Venice, heading west on Center Road and south on U.S. 41, is part of unincorporated Sarasota County. Both the city and the rest of Venice are seeing increased construction as developers get pushed farther south in search of available property. “There's almost no land for builders to build on in central Sarasota County,” says Neal.

In addition to open space, Venice offers other benefits. “The cost of land there is cheaper than, say, the Lakewood Ranch area,” says David Barr, a broker associate with Berkshire Hathaway HomeServices Florida Realty who focuses on new home sales in Venice. “And even if you're east of I-75 in Venice, you're much closer to the beach than when you're east of I-75 in Manatee County. People are starting to figure that out.”

'Next growth corridor'

Venice Mayor John Holic says about 5,000 new homes will be coming in the next 10 to 20 years within the boundaries of the city. Most of those will be in the North Venice area where there's still the most open land.

Much of that land is already accounted for by existing developments such as WCI's Venetian Golf & River Club, which is almost completely built out, and new neighborhoods under construction like Neal's Milano, which has sold 125 of its 798 homes, and D.R. Horton's Toscana Isles.

“The Venice area allows us to offer great communities and quality homes at more attractive price points than areas north in Sarasota and Bradenton,” says Jonathon Pentecost, D.R. Horton's Southwest Florida division president, in an email. “We find that many people are interested in the value proposition we offer, and our sales pace is meeting our expectations.”

How sizable is that “value proposition?” Neal says a home in Venice has a price difference of about $80,000 from a home in Sarasota's Palmer Ranch of equivalent size.

Homes at Milano, for example, start at $227,990. At Windwood, prices start a little higher at $281,990; 76 of the 90 homesites have been sold. When Grand Palm started building, it, too, had a lower price point. But, with about 670 of the 1,099 homesites sold, that will soon be moving higher as Neal shifts to constructing larger, more expensive homes there.

And Neal Communities still has more to come in Venice. One project, the Woods of Venice at Jackson and Border Roads, recently won preliminary approval from the city despite pushback from area residents. If fully approved, Neal expects to start construction on the project in the first quarter of 2018. Neal Communities is also trying to purchase additional land in the greater Venice area, but Neal declines to say where.

By the end of this year, WCI Communities plans to open its sales center at Watercrest, a new development it's building in Venice outside the city limits at Jacaranda Boulevard and East Venice Avenue. The site's 294 residences will include paired villas and single-family homes starting in the mid-$200,000s. It already has about 300 people on a list of interested buyers.

“Venice seems to be the next growth corridor,” says Chris Ryan, WCI's west central division president. “It's got close proximity to the beaches, close proximity to the airport. There are a lot of things pushing people to come to that area.”

In April 2013, WCI also acquired Sarasota National off of U.S. 41 in Venice, which will have 1,354 homes ranging from coach homes to large single-family residences, with prices from the $200,000s to $600,000s.

Who's buying all of these homes? At Neal, 80% of customers come from outside of Sarasota and Manatee counties, and about half of all its sales are cash purchases. The Midwest has become a big source of buyers. “The recovery of the economy has allowed customers to sell their homes there,” says Neal.

Most of the buyers Barr works with are retirees. And because he sees such low inventory when it comes to resales of existing homes, new homes are where many purchasers gravitate.

Just two parcels of land remain open for homebuilding in North Venice, says Holic, both of which are for sale by the owner, the Gulf Coast Community Foundation. The foundation had plans before the recession to build a neighborhood that included workforce housing. “That's a binding plan if someone bought the land today,” says Holic, “or they would have to petition the city planning commission to change it.”

Commercial construction

Much of the commercial construction in Venice is taking place outside the city limits, with a new hub taking shape just off I-75 near the intersection of Jacaranda Boulevard and East Venice Avenue. The 37-acre Jacaranda Junction development will bring a variety of commercial tenants. A Wawa and Culver's are already under construction, with a Burger King coming soon.

“We're working on several other outparcel deals across the front of the property on Jacaranda Boulevard,” says Robbins, who represents the group of investors that owns the site. He's also been in discussions with larger retail tenants for the 200,000-square-foot traditional retail strip that will be built on the eastern side of the property. The owners have sold off seven acres on the south side to a car dealership.

Robbins projects this mini-boom is just getting going. “We're starting to see more national chain restaurants coming to the area,” he says. “Companies that we talked to in the last five years that just weren't interested are now looking to get a foothold in the market.”

A looming challenge to the growth is Venice's demographics can often be a sticking point for businesses. The city's median age has been inching downward during the past several years, but it's still in the mid-60s — not exactly appealing for a restaurant or retailer that targets a younger crowd.

But Robbins has seen things shifting a bit. “What's changed Venice drastically is that people are retiring earlier or getting into a position where they're a consultant and can work out of state and travel,” he says.

And the residential growth foretells growth in the commercial sector. “Every 4,000 homes brings a new Publix,” says Neal. “And every new home represents about 16 jobs for a year.”

Another challenge: with development, especially in Florida, comes the risk of over-development.

Holic believes the city has things under control. For one, he points out many developers in North Venice have voluntarily built at a density of about two units per acre rather than the maximum five units City Council approved. “We're blessed with a very good planning commission, and they take their job very, very seriously,” he says. “So we haven't destroyed what makes Venice Venice.”

Hospitals and hotels

With a boom in commercial and residential growth in Venice, it makes sense medical providers and hotel companies want a piece of the action.

Sarasota Memorial Health Care System and Venice Regional Bayfront Health recently filed certificates of need with state officials for new hospitals in Venice.

SMH's facility would be within city limits at the intersection of Pinebrook and Laurel roads in North Venice. Venice Regional wants to move most of its hospital services off the island of Venice to a new facility outside city limits at East Venice Avenue and Jacaranda Boulevard. It would maintain a freestanding emergency department and ambulatory services on the island. Both hospitals recently received preliminary approvals from state officials.

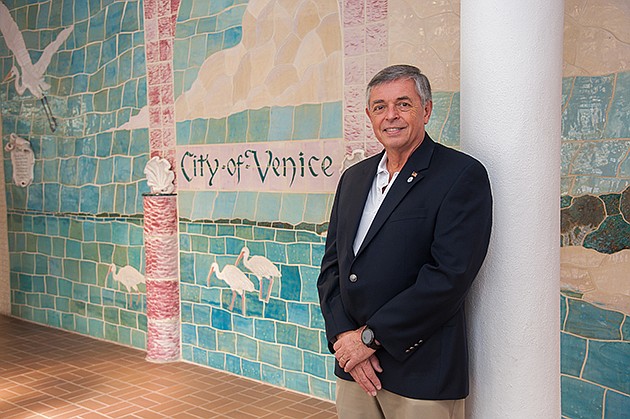

For hotels, two separate proposals have been filed for projects at the old Circus Arena site. Any development there has to be approved by both the city and the Federal Aviation Administration because the land is part of the Venice Municipal Airport. So it's a long process. “But we need more hotels,” Venice Mayor John Holic says.