- February 4, 2026

-

-

Loading

Loading

State legislators will reconvene in Tallahassee on May 23 for a special session on property insurance.

Gov. Ron DeSantis set the dates for the session in a proclamation that says the state needs “to act to stabilize the insurance market for Florida policyholders before the 2022 Atlantic Hurricane Season.”

The session will run through May 27.

In his proclamation, the governor echoes the concerns of insurance agents, insurance companies and others who lay a large part of the blame for Florida’s insurance woes at the feet of lawyers.

He says Florida accounted for 79% of the entire country's insurance lawsuits over claims while making up only 9% of insurance claims. The Florida Association of Insurance Agents says that between 2013 and 2020 insurance carriers in Florida paid out $15 billion in claims costs. Of that, only 8% was paid to consumers. Attorneys got 71%.

“Florida citizens are seeing the effects of this higher litigation in their rising premiums,” DeSantis says in the proclamation, “and the Florida insurance industry has seen two straight years of net underwriting losses exceeding $1 billion each year.”

To make up for the litigation costs and to remain competitive in Florida, some insurance carriers are asking for and getting massive rate increases while others, frustrated by Florida’s system, are just picking up their ball and going home rather doing business in the state.

But rate increases or closing shop may not be enough. In the past three months three insurance companies offering coverage for homeowners have become insolvent and are either in liquidation or rehabilitation and several other others have either stopped renewing policies or stopped writing new business, DeSantis says.

All of this is creating massive problems for Citizens Property Insurance Corp., which is only allowed to raise its rates 11%. Citizens was created in 2002 as a last resort for property owners unable to secure coverage from private companies, but industry leaders and critics say it is too often the only choice or one of the few choices.

According to DeSantis, Citizens has seen an increase of 399,822 policies since the start of 2020 and is on track to have more than 1 million policies by year end. Citizens had 421,332 policies at the end of 2019.

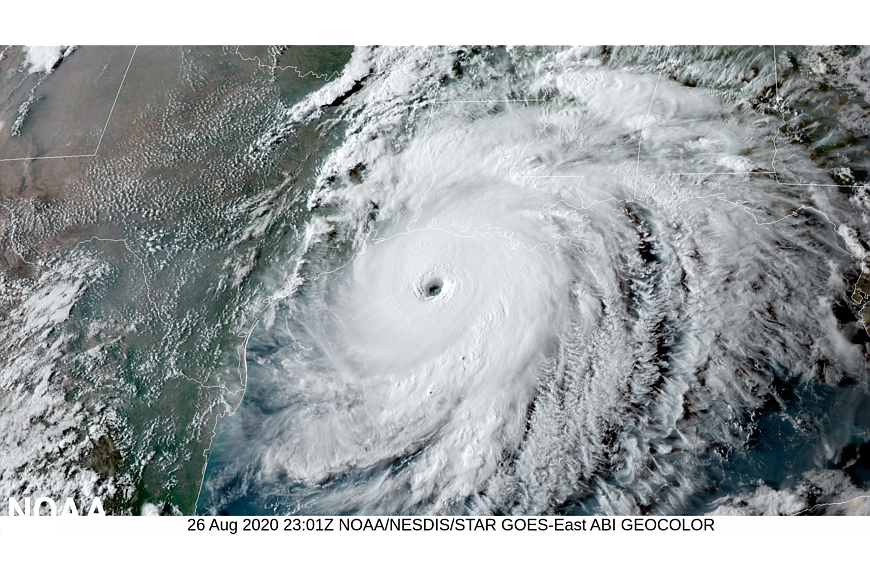

The concern is with Citizens being overburdened, a major hurricane could cost the state billions, with rates on most other insurance policies in the state spiking to cover claims and insurance carriers without enough reserves collapsing.

Although a handful of bills to address the issue came up during the legislative session earlier this year, there was no meaningful reform to a system that many businesses, property owners, government officials and those in the industry all agree is in desperate need of reform.