- February 14, 2026

-

-

Loading

Loading

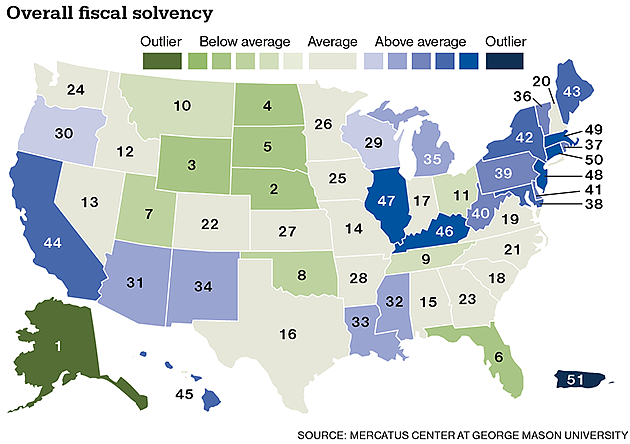

While some politicians might say otherwise, Florida's fiscal health, at least in comparison to most other states, is strong, according to a new study.