- February 3, 2026

-

-

Loading

Loading

Fees lawyers are allowed to collect when filing insurance claims are helping push an already precarious property insurance system in Florida to the brink, causing rates to skyrocket and leaving the state one big storm away from total catastrophe.

That’s the opinion of insurance agents, some state officials, homeowner associations and lobbyists who want the state legislature to act — now. They say if the state can cap fees or implement a fee schedule, it will begin to bring back carriers who have left, taking pressure off of the state’s insurance company, Citizens Property Insurance Corp., helping bring down rates and, most importantly, strengthening the entire system.

The problem with rising rates and the fear the system is teetering on the brink is not new nor is it solely the result of high attorney fees. Neither are the concerns about the health and stability of Citizens, created in 2002 as a last resort for property owners unable to secure coverage from private companies, but is too often the only choice or one of the few choices.

Story continues below.

Critics believe these high fees awarded to attorneys are a big reason many property insurance carriers are reluctant to sell policies in the state. It is also one of the big reasons why the carriers that do stay have to raise rates. Officials with the Florida Justice Association, formerly the Academy of Florida Trial Lawyers, declined to comment for this story.

What’s happening is that left with fewer options, homeowners turn to Citizens, a precarious situation. According to Citizens, it is adding about 5,000 new polices a week and had 759,305 policies in effect as of Dec. 31. Citizens did hit 1.4 million policies in 2012, but the number of policies slowly fell in the years since, reaching 421,332 in 2019.

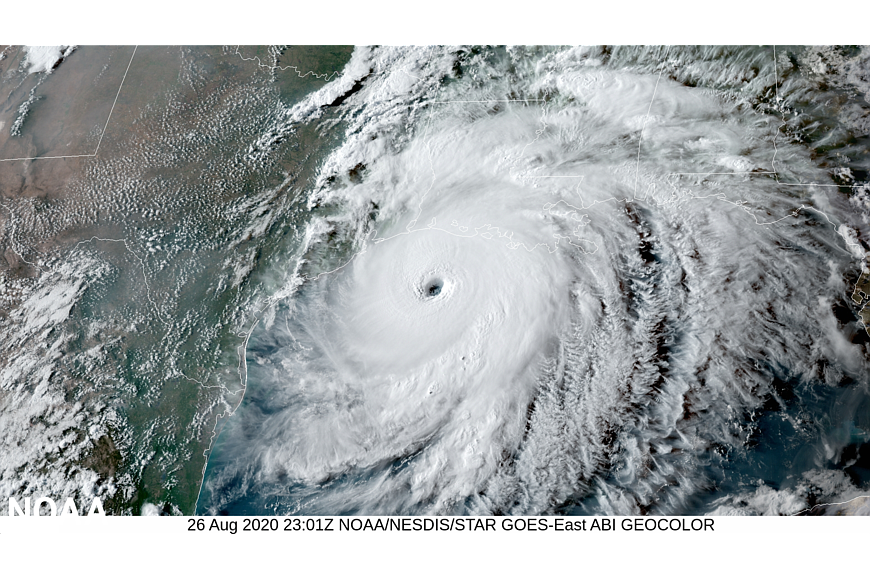

The concern is with Citizens being overburdened, a major hurricane could cost the state billions, with rates on most insurance policies in the state spiking to cover claims and insurance carriers without enough reserves collapsing.

Addressing the fees will not solve the entire problem, but critics say it would go a long way toward improving the situation.

“There’s no rhyme or reason for it,” says Matthew Mercier, national practice leader for the community association division of CBIZ Insurance Services in Sarasota. “I think if we can address that, that will attract carriers to come into the marketplace because they will have more certainty about the litigious nature of our state.”

So just how bad is the problem?

According to the Florida Association of Insurance Agents, between 2013 and 2020, insurance carriers in Florida paid out $15 billion in claims costs. Of that, only 8% was paid to consumers. Attorneys got 71%.

This, naturally, translates into higher costs for home and property owners. Florida property owners, the association says, paid $651 more in rates in 2020 than property owners in Georgia and Alabama.

And it’s going to get worse. Insurance carriers are asking for and getting massive rate increases in order to stay competitive in the state and to be able to cover claims. That too is creating problems for Citizens — which is only allowed to raise its rates 11%.

The association says the difference between what Florida property owners pay and what property owners in Georgia and Alabama pay is going to jump to $866 this year.

“Years of fraud and frivolous litigation pushed the Florida homeowners insurance market into crisis,” says Kyle Ulrich, FAIA’s president and CEO.

Ulrich points to the legislature adjusting the state’s one-way attorney’s fees statute to determine fees during last year’s session. It’s a start, he says, “but everyone involved knew that it could take years for those reforms to stabilize premiums for consumers.”

Mercier calls the one-way statute a “loser-pays system that only works in one direction, from the insurer to the insured. If the insurer succeeds, it is not entitled to recover attorney fees from the insured.”

Agents and lobbyists aren’t the only ones concerned about the state of property insurance and how attorney fees are affecting the market.

In December, when Citizens’ board approved the rate hike, the organization reported the state’s property insurance market was facing major challenges. It said the 52 private companies writing 79% of property insurance policies in the state lost $847 million through the third quarter of 2021. While that was happening, Florida led the nation in litigation.

According to Citizens, Florida accounted for 8% of policies in 2019, yet the state accounts for 76% of all litigation nationwide. “We have a litigation system that is truly, absolutely out of control,” Citizens President, CEO and Executive Director Barry Gilway says.

Sarasota homebuilder and the chair of Citizens’ board Carlos Beruff went a little further. He says in the report that growing premiums and high litigation rates make it nearly impossible for Citizens to shrink.

“We need to take a look at all our options to stop this unsustainable trajectory,” says Beruff, CEO and founder of Medallion Homes. “Any solution is going to require legislative action to provide Citizens with the tools and flexibility to return to its role as an insurer of last resort.”

There is legislation proposed this session that will allow surplus line carriers into the state.

These lines aren’t controlled by the Florida Office of Insurance Regulation and often don’t use standard state-mandated forms. But many of the companies are well capitalized and those looking for substantial change say if guardrails are in place to ensure the best of these carriers come in, it would help.

Travis Moore is a St. Petersburg lobbyist who represents community and condominium associations. He says the rate increases are hitting his clients hard because the cost of insurance is the highest budget item for any association. So, as rates rise, so do residents’ dues.

This is coupled with new regulations coming down the pike as a result of the Surfside condo collapse.

“You start adding all that up, and things that are $500 a month quickly go to six, seven, eight, $900 a month,” says Moore, with Moore Relations. “For people, that’s hard to come by. At some point we’re going to get to a place, really quickly, where insurance premiums are more than your mortgage.”