- July 26, 2024

-

-

Loading

Loading

Naples-based radio station and media company Beasley Broadcast Group has had a challenging month — and one industry analyst says 2024 might not be too rosy, either.

In an Oct. 13 public filing, Beasley says it received written notice from Nasdaq that because its share price was under $1 for 30 consecutive business days, it’s at risk of being delisted from the exchange. The company, traded under the symbol BBGI, closed at $0.79 a share Nov. 10. The last day it closed over $1 a share was Aug. 30, when it closed at $1.01.

The company, according to its filing with the Securities and Exchange Commission, says it has until April 10, 2024, to “regain compliance.” It can then be eligible for an additional 180-day extension if it satisfies certain Nasdaq requirements.

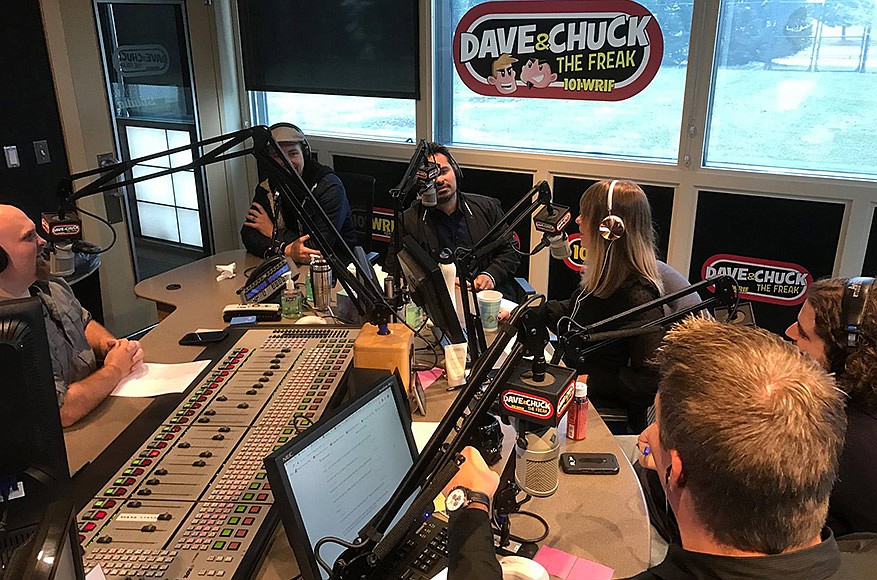

Beasley, which owns 61 stations in 15 U.S. markets and posted $256.38 million in revenue in 2022, touched on the delisting notice again Nov. 2 in its quarterly earnings statement. “We intend to actively monitor the closing bid price of our Class A common stock and will consider all reasonable available options to regain compliance,” the company says, in part, in the risk factor section. That may include transferring the listing to a lower-level exchange and/or seeking stockholder approval for a reverse stock split.

“If we are delisted from Nasdaq but obtain a substitute listing for our Class A common stock,” the company adds, “it will likely be on a market with less liquidity, and therefore experience potentially more price volatility than experienced on Nasdaq.

This is the second time Beasley Broadcast Group has received a potential delisting letter for a stock under $1. The first one came April 27. But the matter was closed a month later, the company said, when its stock was over $1 for the required consecutive days.

Other challenges loom over the company.

Revenue, for one, decreased 5.8% in the third quarter over the 2022 third quarter, according to the Nov. 2 earnings report and ensuing conference call, to $60.1 million. Beasley CEO Caroline Beasley, in the call, attributed the drop to “continued softness in the advertising market with the cyclical offset of political” advertising. (On the flip side, digital ad revenue rose 9.1%, the company says, while specific, local network advertising increased 35% in the quarter.)

The company’s lingering debt situation is another concern. It had $283.6 million in debt at the end of the third quarter, according to the earnings report.

Radio media industry analyst Jerry Del Colliano wrote about the issues at Beasley in a mid-October report. “Like other troubled radio groups, Beasley has too much debt,” he wrote in the Inside Music Media newsletter, according to an account of it in Radio World magazine, noting how three other radio station companies with heavy debt loads have filed for bankruptcy. “The same problem that brought down Cumulus first, then iHeart and Audacy next before the end of the year.”