- July 26, 2024

-

-

Loading

Loading

NORTH FORT MYERS — A North Fort Myers couple entered pleas of no contest in an advance fee for loan scheme, with the husband receiving a prison sentence followed by probation while his wife received solely probation.

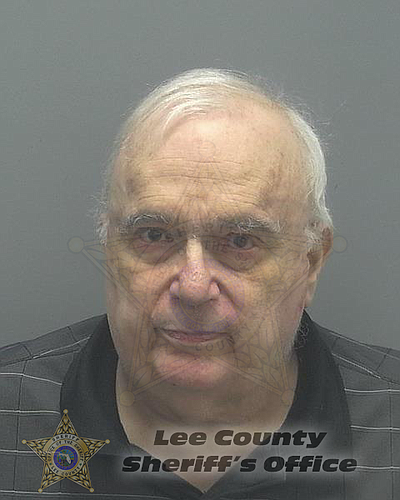

The Florida Office of Financial Regulation in Tallahassee announced via a news release Oct. 11 that Barry Vigoda has been sentenced to more than two years in prison, followed by 10 years of probation, for his role in a fraudulent loan scheme after a plea of no contest. He was also ordered to pay more than $151,000 in restitution, as well as associated court costs, the release adds.

The release says his wife, Catherine Vigoda, co-conspirator in the scheme, was sentenced to 10 years of probation and ordered to pay restitution after a no contest plea.

"In Florida, it is illegal for a loan broker to assess or collect any fees in advance of a loan closing, and we will continue to work to protect citizens from these scams,” Alex Toledo, OFR Acting Bureau Chief of Financial Investigations, says in the release.

From July 2016 to June 2017, the Vigodas used a website, www.gulfcoastmortgageservices.com, to offer commercial loans to prospective borrowers, displaying “client testimonials” that claimed the company had obtained more than $400 million in commercial loans and had more than $450 million in loans pending, authorities alleged. Victims reported being told the advance fee was fully refundable if the loan was not funded, the release adds.

The OFR investigation revealed, however, no business loans or refunds ever materialized.

The Lee County Sheriff’s Office executed the arrest warrants. The State Attorney for the 20th Judicial Circuit in Lee County prosecuted the case.