- July 26, 2024

-

-

Loading

Loading

The commercial real estate industry’s outlook on the economy and other economic factors is improving. But that’s only if you look at things from the bright side.

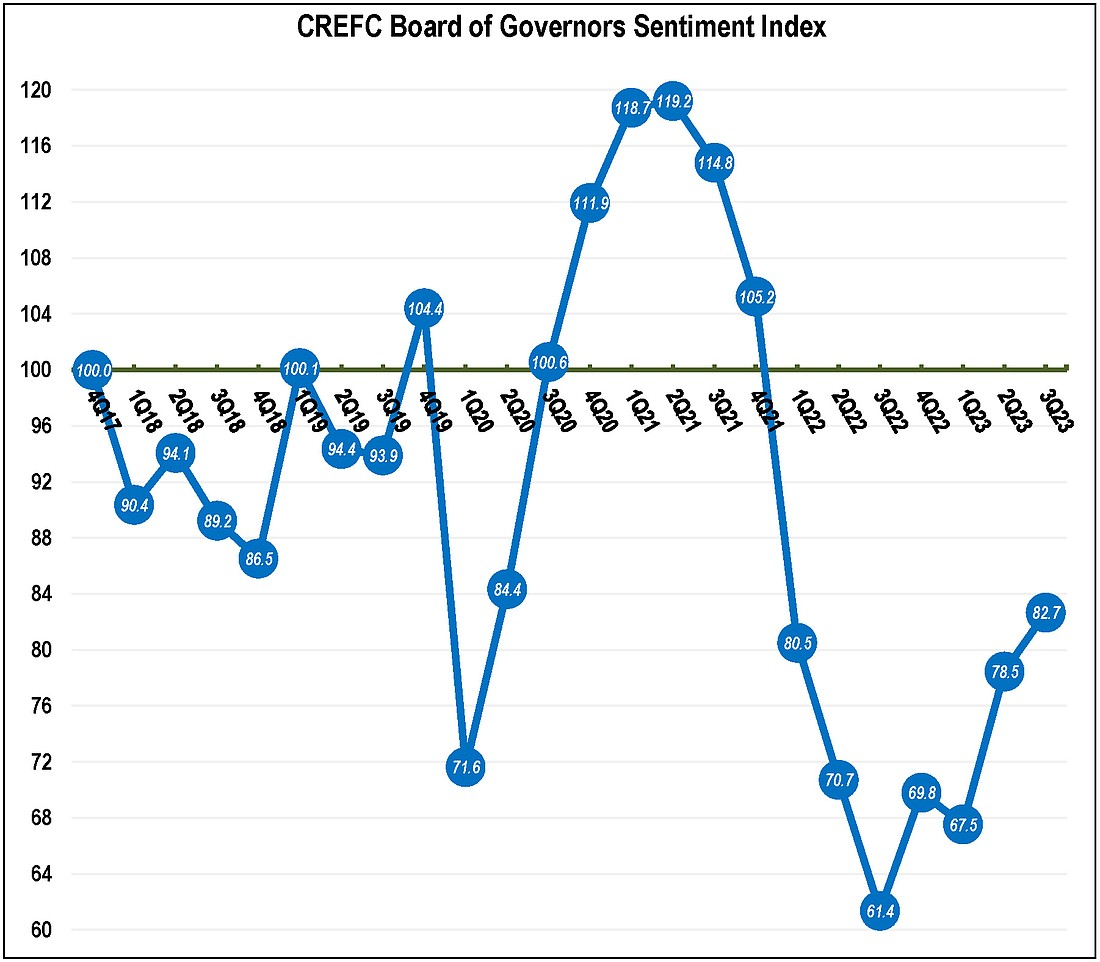

The CRE Finance Council last week reported its latest Board of Governors Sentiment Index rose by 5%, from 78.5 in the previous quarter to 82.7. This, the organization says, signals “a cautious uptick in sentiment.”

The quarterly index tracks commercial real estate finance market conditions and outlooks as seen by senior members of the industry. The latest index was for the third quarter and the survey was administered Sept. 12 and Sept. 22.

As with deals, the full story is found in the details.

While sentiments about the industry’s finance business is up, 58% maintain a negative outlook, which, at least, is down from 67% the previous quarter

Lisa Pendergast, the finance council’s executive director, says the results signal “a tempered increase in optimism; however, the texture of this optimism is layered.”

“Key concerns reverberate around the anticipation of higher-for-longer rates, regulatory overstep and the broader economy.”

Among the concerns is the multifamily sector. The survey’s respondents found low, but increasing, mortgage delinquencies, doubling borrowing costs, slowing rent growth and rising building expenses as reasons for worry.

According to the finding, “outstanding multifamily mortgages more than doubled over the past decade to about $2 trillion. That is nearly twice the amount of office debt.”

According to the survey, the finance council also found: