- July 26, 2024

-

-

Loading

Loading

The SBA lending sector, which for some banks has been a profitable and prolific source of activity, is poised to get a bit more crowded.

In Florida, for starters, two new SBA lending entities have recently entered the market. One is Sanibel Captiva Community Bank, which recently announced it’s expanding to SBA loans, including SBA 7(a) and 504 loans and SBA express lines of credit. The other is Fort Lauderdale-based OptimumBank, which, in a statement, says it seeks to “fund the production of $25 million in SBA loans” in fiscal 2023.

OptimumBank officials add that the bank will focus on 7(a) loans, which tend to be used for acquiring a business or working capital. The other primary SBA lending entity, a 504 loan, is primarily for buying commercial real estate or heavy machinery and equipment and is utilized less frequently than 7(a) loans.

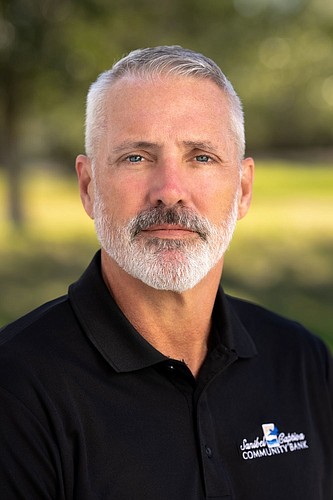

Both banks have named senior lenders to head the SBA units. At Sanibel Captiva, a $729 million asset bank known as SanCap, with a heavy focus on Lee County, Senior Vice President Lee Golden will run the SBA unit. “For many small business owners, finding the right source of funding can be difficult,” SanCap President and CEO Kyle DeCicco says in a statement. “With the creation of our SBA lending team, we can meet the needs of more of our business customers to help them grow and sustain their local businesses in Southwest Florida.”

The pair of new SBA lenders will face competitive forces — both established and in the near future.

On the established, three banks based in the region, St. Petersburg-based BayFirst, Winter Haven-based SouthState and The Bank of Tampa, are among the top 10 in statewide SBA loan volume in fiscal 2023, SBA loan data shows. BayFirst has prioritized SBA lending for several years, and closed out fiscal 2022 as the No. 8 SBA lender nationwide. It expanded its SBA reach earlier this year, when it named longtime Manatee County community banker Charlie Conoley vice president of USDA Rural Development Lending — a new SBA position for the bank, with $1.06 billion in assets.

On a national level, meanwhile, the Small Business Administration recently ended a 40-year moratorium on what kind of entities can handle SBA loans. The rule since 1982 was that to handle SBA loans for clients, the lender has to be a bank or one of 14 pre-approved non bank companies focused on small business lending.

The rule change, administration officials say, was designed to open the SBA loan market to fintech and other firms, and, in turn, boost SBA loans to minority and other underrepresented companies. But lobbying groups for banks and credit unions, among others, contend that opening the market exposes SBA loan clients to more fraud and other issues.

There have been 37,365 SBA 7(a) loans in fiscal 2023 through June 9, according to SBA data. The loans total $17.79 billion, an average of $476,219 a loan.