- October 22, 2024

-

-

Loading

Loading

The commercial real estate industry, based on the results of a large recent survey, is gearing up for some rough patches — but it could be worse.

The report, the 2022 Trepp CRE Sentiment survey, found that “for several parts of the economy, the most severe outcome would be avoided.” New York City-based Trepp, an industry data and analytics firms, polled its podcast listeners, clients and blog readers, mostly commercial real estate brokers and property owners and industry executives, from July 13 to Aug. 1.

Avoiding severity, of course, isn’t exactly an A-OK message. The industry is forecasting several potholes in the next year. For one, in general, when asked about the condition of the commercial real estate markets, “most respondents indicated headwinds were outpacing tailwinds.”

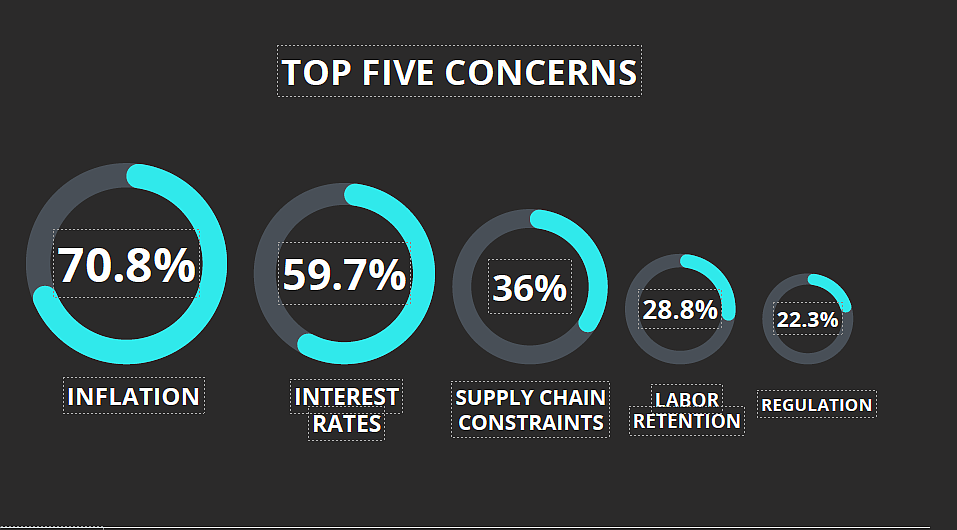

The report also found that more than half the respondents believe economic conditions and higher interest rates will impact their businesses negatively. And, notably, by a ratio of more than 10 to 1, respondents predict delinquencies in commercial real estate and commercial mortgage-backed securities will rise over the next six months. That would be a reversal of the overall trend of a declining commercial mortgage-backed securities delinquency rate for 23 of the past 25 months, the report shows. “Not surprisingly,” the report states, “inflation, higher interest rates and supply chain constraints were the biggest macro concerns in the survey.”

Other findings of the survey include: