- July 26, 2024

-

-

Loading

Loading

For Kevin Hart, the foundation of any tech company should be solving a problem.

“You see a pain point — is there a way to lessen that pain point or even obliterate it?” he asks.

When he founded Bonita Springs-based Green Check Verified, a fintech provider of compliant cannabis banking solutions and services, in 2017, he knew obliterating a pain point wasn’t an option. Regulations around the cannabis industry — and the industry itself — are constantly changing. But he could offer a way to lessen that pain.

“How do you take two highly regulated industries that would love to be able to work together, but it’s really hard to figure out how the rules and regulations change so much on each side,” says Hart, 63. “That screams technology. Technology could connect the two industries by looking at the data, enabling the data, providing the data, and making it actionable for both sides.”

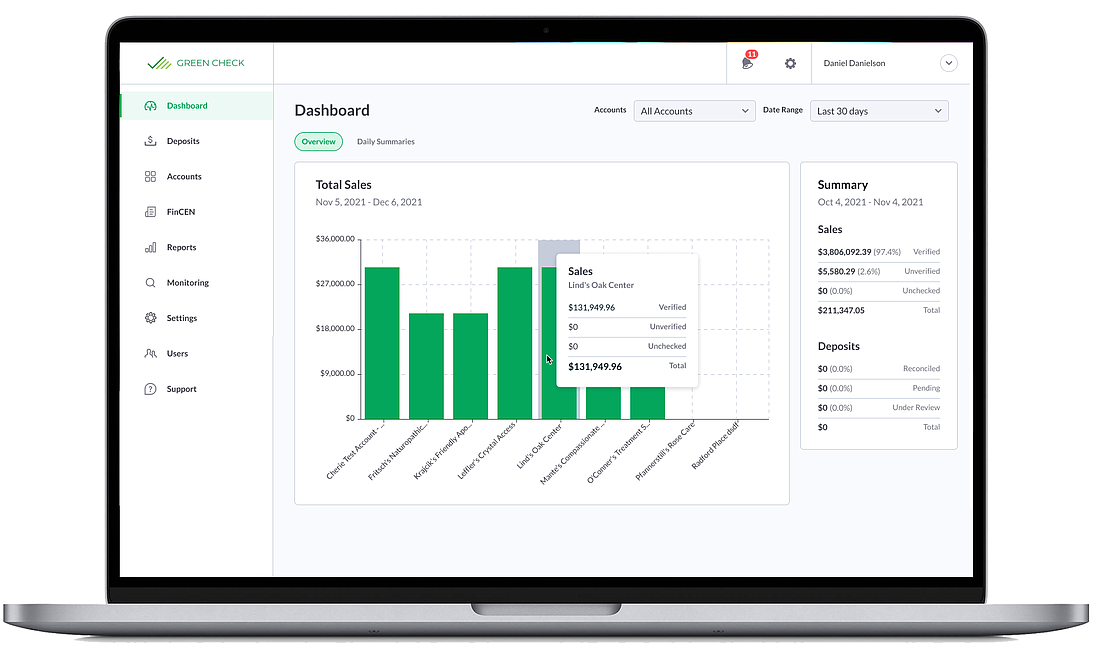

Green Check Verified helps connect financial institutions and legal cannabis businesses in need of banking services. By using technology, the regulatory software and services company ensures both sides are compliant with all applicable rules and develop relationships that benefit each of them. “Just because a state gave you a [cannabis] license," says Hart, "it doesn’t mean you’re going to run a complaint business.”

Rules and regulations vary based on type of cannabis business, license type, geographic location, and market served. “They just constantly change,” says Hart. “So we digitized all that. Then we have to ingest the data and make it presentable for both sides. Cannabis businesses need to know how well they’re operating, and the financial institution needs to be able to say this is legal by state rules and regulations, we can bank this. It’s a complex data puzzle."

Green Check Verified works with more than 2,500 cannabis businesses and has more than 100 financial institutions on its platform operating in 38 states.It’s free for cannabis businesses to be on the platform; financial institutions pay a fee.

Hart says that despite coming to market after some competitors, Green Check Verified has surged ahead. “We’re over 4x or 5x bigger than our closet competitor, having been in the market a significantly shorter period of time,” he says. “The key reason is we began with the end in mind…We spent close to two years defining what the product should do before we wrote a single line of code.”

Hart admits that in the early days, he was too focused on how you could bank cannabis businesses and didn’t think enough about explaining why you would want to offer banking services to cannabis businesses.

“We’re a technology company, and I was leading with the how,” he says. “From prior work experience and tech company experience, at that time, it made sense. But what we underestimated was the education that we were going to have go through, letting financial institutions know why they should bank the cannabis industry. If you give people the reason why and let them know that they can…if they’re interested then the how becomes the easy part.”

The company had to change its approach and focus more on education. It offers a free monthly Cannabis Banking Bootcamp to educate U.S. financial institutions about safely and successfully providing banking services for the legal cannabis industry. Those boot camps have been attended by more than 800 financial institutions to date.

The company also publishes its data on state and federal rules and regulations on its website for anyone to access. “You can see all the rules and regulations that you would have to account for if you’re a financial institution and how we digitize that,” says Hart. “So now people can see how complex it really is.”

“The cannabis industry still has a compounded annual growth rate of 30% nationally,” Hart says, pointing to a long runway.

More and more states are establishing new cannabis programs, and federal action is also a possibility.Washington is going to do something one of these days, either on deregulation, legalization, and/or the SAFE Banking Act,” says Hart “And maybe all three, who knows?”

Hart expects financial institutions to expand the products and services they offer to legal cannabis industries, which would mean more opportunities for Green Check Verified. International commerce is also on the horizon. “So the rule sets and the rules and regulations are going to become more and more complex,” he says. “Because we started with compliance and that complex rule set as starting point, we’re going to be in the optimal position to make sure that our financial partners and the industry itself continues to be served well. It’s exciting times.”