- July 26, 2024

-

-

Loading

Loading

The insurance industry is having an acquisition moment.

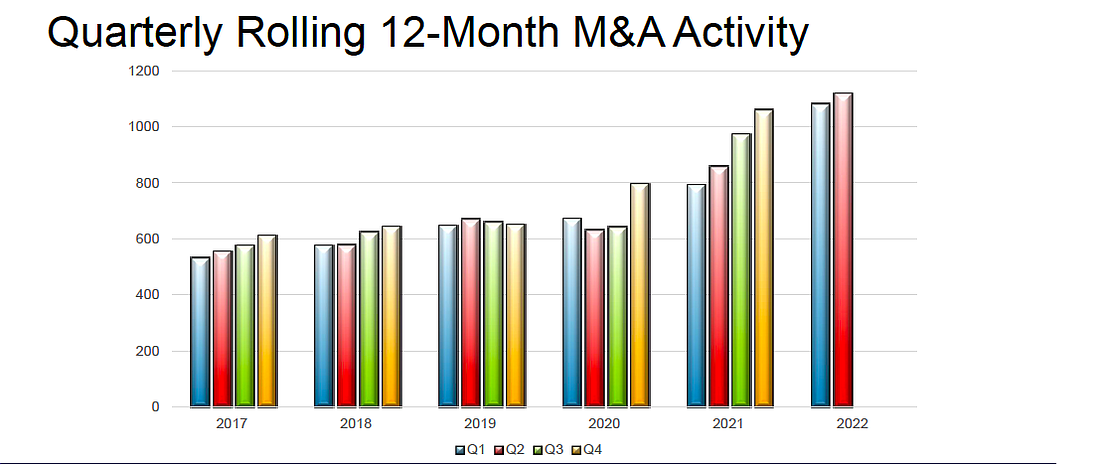

There were 426 insurance mergers and deals in the first six months of 2022. That’s up 16% from 369 deals in the first half of 2021, according to a new report from agent-broker M&A advisory firm Optis Partners LLC. The second quarter of 2022 was especially busy: With a 20% increase in deals, it was the fourth-most-active quarter of all time.

Notably, M&A activity in the sector is up 13% over the first-half five-year average, the report also found. That’s a period regarded as the insurance industry’s most active M&A market ever.

The list of individual firms doing the acquiring is a bit top-heavy, as the top 10 accounted for 55% of all deals in the first half of the year. Utah-based PCF led the way, with 48 deals, up 71% from 28 deals in the first six months of 2021, the report shows. Acrisure and Hub were No. 2 and No. 3 on the list, with each up 40% in deals over 2021.

The report notes that buyers also seek opportunities to acquire companies that are adjacent and related to insurance distribution and the agency/brokerage business. That list includes life/financial services and actuarial and human resources consulting.

Fort Myers-based Foster & Foster Consulting Actuaries is one local example of a company following that trend. The health and welfare plan consulting firm, which provides pension-consulting services for public entities, recently acquired California-based Bartel Associates LLC. Founded in 1979, Foster & Foster acquired firms in the same niche in both Pennsylvania and Michigan in 2021, according to a statement.

Another area company that’s been a big player in the insurance acquisition market is Tampa-based BRP Group. The publicly-traded insurance brokerage has acquired at least 20 companies in the past five years, in a dozen states. The firm’s deals in 2021 represented over $200 million in additional annual revenues.