- July 26, 2024

-

-

Loading

Loading

The story of skyrocketing rents in the region, quickly cascading to crisis level, is hitting businesses hard, as workers struggle to afford to live in the areas where they work. Now that story has an eye-popping data component, in the latest report from real estate analytics firm CoStar.

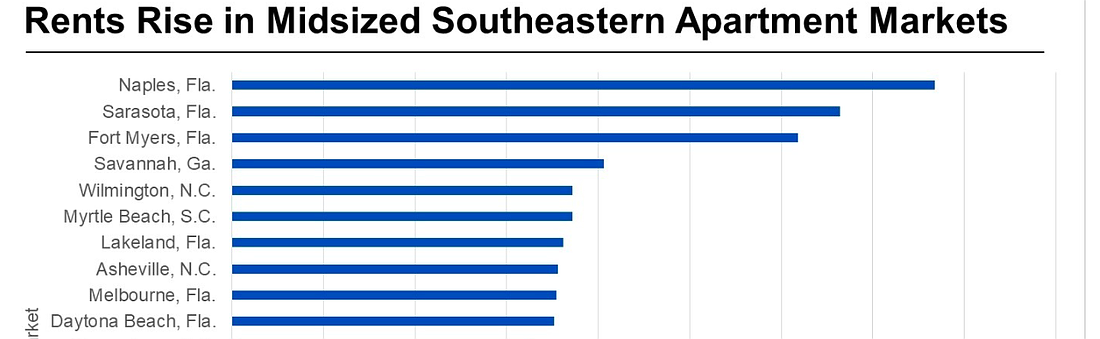

The report looked at year-over-year rent growth in March at midsized Southeast apartment markets, defined as cities with 10,000 to 50,000 multifamily units. Seven out of the top 20 markets for annual rent increase are in Florida. And, notably, the top three — Naples, Sarasota and Fort Myers — are all on the west coast of the state. Overall, average rent growth in midsize Southeast markets is up 23.1% year-over-year. In markets with 50,000 or more units, the increase, the report found, is 21.1%

On the top three, all the markets are up at least 30%: Naples at 38.4%, Sarasota at 33.2% and Fort Myers at 30.9%. Also close by is No. 7 on the list, Lakeland, with an 18.1% increase. In actual dollars, the report offers this example: rents in Sarasota now average $1,922 per month — more than $200 per month more than nearby Tampa. (Lakeland, at an average of $1,408 a month, is a relative bargain.)

The how, on how to solve the issue, is way more complicated than the why. For the most part, the why comes down to simple supply and demand.

The report notes “builders are looking to capitalize on the strong rent growth observed in many of these smaller metropolitan areas and are busy breaking ground on new projects to meet recent demand trends.” A drive around nearly any city and town in Florida can prove that.

“Places such as Myrtle Beach, Naples, Fort Myers and Lakeland rank as some of the most supply-heavy midsized metropolitan areas in terms of supply underway and net completions as a percent of inventory,” the report adds, citing National Association of Home Builders data.

“But the increase in supply could take years to meet the newfound demand, and each of these fast-growing cities rank highly for both apartment demand and rent growth,” the report adds. “Remote work trends, the acceleration of retirements and tight, single-family for-sale inventories have increased the appetite for renting in smaller markets with limited existing supply.”

Going deeper into the issue, the report states homeownership rates in Florida trend higher than other Southeastern states. That leads to “limited new supply relative to population growth,” the report states.

Nearly 77% of Sarasota households, for example, live in an owner-occupied housing unit as of 2019. “That lack of earlier investment has put extreme pressure on the existing multifamily rental supply, with stabilized vacancy rates, which account only for properties 18 months or older, at around 3%,” the report states. “In Savannah, by contrast, where the homeownership rate is 60%, the stabilized vacancy rate is just above 5%.”