- July 26, 2024

-

-

Loading

Loading

Florida Atlantic University and Florida International University researchers are crashing the Sunshine State real estate party — with some alarming, if not totally surprising, news: the market is overheated.

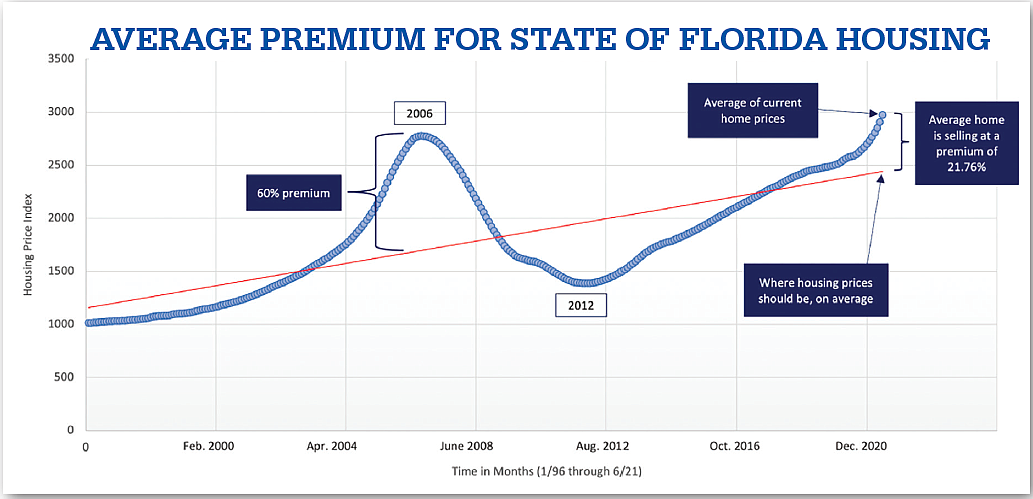

Homes in Florida were selling for 21.76% over their long time pricing trend through June 30, a report from the colleges found. That’s up from 19.24% in May and 17.17% in April. “Florida homes keep fetching more money than they’re worth, a disturbing development that eventually could put buyers in a bind,” the report states.

Tampa Bay is the most concerning of the state’s major metropolitan areas, the data shows. Homes in that region sold in June for a 32% premium, up from 28.53% in May and 26.14% in April.

There is some good news: citing a shortage of homes for sale, a steady influx of out-of-state buyers and mortgage rates near historic lows, the researchers aren’t predicting a housing crash like the one a decade ago. Back then Florida homes were overvalued by 60% or more. Others in real estate have made similar predictions of a soft landing, not a bursting bubble.

But property appreciation eventually will taper off, the report suggests, and recent buyers who paid top prices risk being stuck for a significant amount of time before they can realize solid returns on their investments, says Ken Johnson, a real estate economist and associate dean in FAU’s College of Business.

“The across-the-board increase in the premiums paid for housing throughout the state is very worrisome,” Johnson says in a FAU blog post. “Trees do not grow to the sky and neither do home prices. We’re nowhere near where we were at the peak of the last housing cycle, but we do need to be careful. Walking away from an obviously overvalued home may be the best thing buyers can do in this kind of market.”

The research team, in conducting their monthly analysis, review more than 25 years of home prices from online real estate portal Zillow. The data includes single-family homes, townhomes, condominiums and co-ops.

Given the level of overpricing, Johnson and Eli Beracha, with FIU’s Hollo School of Real Estate, says Florida consumers almost certainly would be better off renting a home and reinvesting the money they would have spent on ownership. Of course, rents, in single-family and multifamily, are also exploding. But slower than home prices, the report states.

“Our research on buy vs. rent indicates that, on average right now, renting and reinvesting is a particularly good wealth creation strategy,” Beracha says in the report. “More people who rent and reinvest would help alleviate current pricing pressure, which is a good thing.”