- July 26, 2024

-

-

Loading

Loading

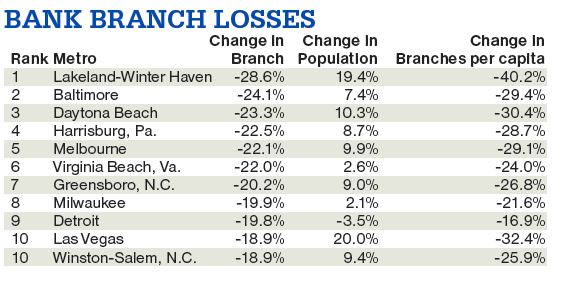

Lakeland-Winter Haven, despite a decade-long population surge, lags in one distinct metric among the largest 100 metro areas nationwide: It has lost the highest percentage of bank branches over the past 10 years.

And according to a new report on the decline in bank branches, the Lakeland-Winter Haven area, thanks to a 19% population increase from 2008-2018, had 40% fewer banks per 100,000 residents. That’s also tops nationally, according to the report, from BankDepsoits.com, a unit of LendingTree. The report analyzed Federal Deposit Insurance Corp. data.

Towns and cities losing bank branches, of course, isn’t breaking news. The move to online and mobile banking, combined with the push to reel in millennial customers, has fueled the decline of branches industry wide for years. Yet some banks, particularly community-focused ones with a demographic that skews older (like in Florida) have maintained a branch presence — albeit one with more gadgets and technology inside.

Two other Florida regions joined Lakeland-Winter Haven on the BankDepsoits.com lost bank branch list, Daytona Beach and Melbourne, which were No. 3 and No. 5, respectively.

Six regions nationwide, meanwhile, gained branches, the report shows — though those areas, due to population growth, posted percentage losses in branches per capita. Regions that gained branches include Raleigh, N.C., Boston and San Jose.

After peaking at almost 100,000 in 2009, the number of bank branches nationally started to slide in 2010. By 2017, the total branch count nationally, the report states, had fallen to 89,847.