- July 26, 2024

-

-

Loading

Loading

An awning manufacturer, a candy maker and a cruise ship company seemingly have little in common.

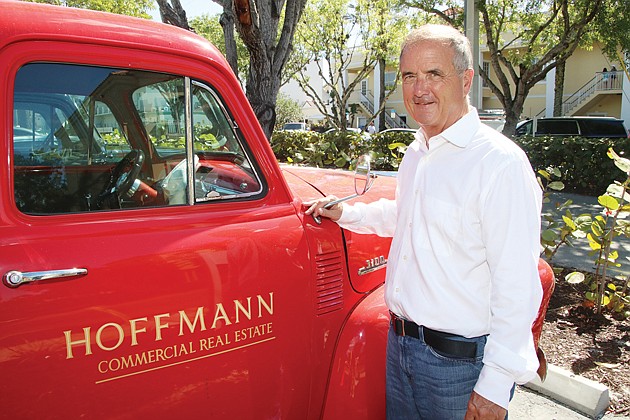

But in the world of David Hoffmann — his family business, Chicago-based Hoffmann Commercial Real Estate, is the largest commercial property owner in downtown Naples in terms of square feet — the tie-ups make sense.

While Greg Hoffmann, David's Hoffmann's son, handles much of the real estate investing, the elder Hoffmann runs Osprey Capital LLC. That entity, a private family office structure that's grown popular among high-net-worth individuals of late, is a $2 billion fund with worldwide holdings everywhere from oil distribution to aviation and winemaking. The Wilmette, Ill.-based fund, according to its website, aims to double its assets in the next six to eight years through organic growth and acquisitions.

Then there's the latest Naples acquisitions — all three of which are headed for expansion.

The candy maker, AdelHeidi's Organic Sweets, is a 7-year-old business with two locations and a wholesale grocery business. Hoffmann plans to open a store every month statewide, and add hundreds of supermarkets to ones that already sell the company's products.

Awning and canvas products manufacturer Sunmaster of Naples, with 70 employees, will also expand. “All of their products can be used nationally and should be,” he says.

The 150-foot Naples Princess, meanwhile, will get some upgrades and a restaurant next to her docks, says Hoffmann. The waterfront operation fits well with Osprey Capital's other entertainment and hospitality businesses, he says.

“It's a big deal down here,” he says. “They have 60,000 visitors a year to that boat.”

To make the acquisitions, Hoffmann took time away from the family's $300 million Naples commercial real estate shopping spree that's netted 21 downtown buildings in the past two years. He declines to say what Osprey Capital paid for the latest business acquisitions, but says familiarity with them as a customer convinced him he's buying value.

Former owners and executives of the new Osprey businesses will help guide the expanded operations and entries into new markets. That's a key part of the strategy, to utilize inside talent and be a mostly hands-off owner. “We may add some value-thinking strategy and provide growth capital,” says Hoffmann, who splits time between Naples and Chicago.

Hoffmann says strong favorable impressions of the businesses and their management led him to approach the owners about an acquisition.

Sunmaster, for example, built and installed awnings, gates and other fixtures at Osprey-owned buildings in Naples. “We had firsthand knowledge of them as customers,” Hoffmann says.

On AdelHeidi's, Hoffmann and his wife, Jerri, fell in love with the offerings of the shop on a walk in downtown Naples. Hoffmann later leased space to the owners to open a second shop. “The gelato is the best I have ever tasted,” he says.

And the Naples Princess has been on Hoffmann's most-admired list. “We liked the management a great deal,” he says. “They are the only large cruise ship of its kind in Naples.”

The 25-year-old Princess, which sails from Port of Naples Marina and accommodates up to 300 passengers, will undergo a refurbishment that includes a new kitchen and carpeting.

A priority for Sunmaster, already the largest awning maker in Southwest Florida, is to widen national distribution of the company's patented “Titan” motorized retractable screens used in new condos and homes.

Expansion plans for AdelHeidi's include more stores in Naples. Then Fort Myers and Palm Beach, and from there the rest of Florida. Locations in Illinois, Colorado and St. Louis will follow, Hoffmann says, and he expects he will need a packing plant to service every 10 stores.

What's next for Hoffmann and Osprey Capital? Not sure, but he loves Southwest Florida's demographics and business opportunities. Says Hoffmann: “You never know when we're going to strike.”