- July 26, 2024

-

-

Loading

Loading

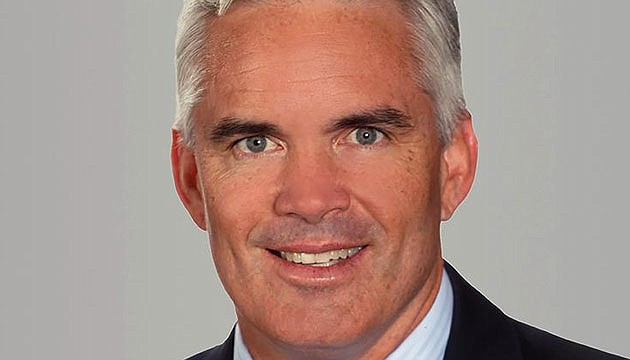

SCOTT GARLICK

Managing Principal

Cushman & Wakefield

Tampa

Scott Garlick joined commercial real estate firm Cushman & Wakefield a decade ago, following a successful 12-year pro career as a soccer goalie with teams like DC United. At Cushman, Garlick became a member of the firm's office and industrial brokerage services group, where he partnered with Senior Director John Fish. The pair won numerous awards within the firm, including “Deal of the Year” and “Client Service Top Performer.” In all, Garlick negotiated transactions totaling more than 5 million square feet. In January, Garlick was tapped to replace Larry Richey as the firm's managing principal in Tampa.

What's your perspective regarding the performance of the Tampa commercial real estate market at present?

I think the market is incredibly active, either from the office, industrial or retail asset class perspective. The market is highlighted by a lack of supply on both the office and industrial side, and vacancy rates in a lot of the supply out there have been dropping below 10%, which we in the industry consider to be a point of tenant/landlord equilibrium. So it's largely a landlord market right now, and a lot of the the fundamentals are very strong.

Why has no new office space been developed during this cycle in the Tampa area? Various projects, both downtown and in Westshore, are talked about, but supply has continued to be constrained at a time when the velocity of deals seems to be accelerating.

There are a couple of reasons for that. Namely, financing for speculative office projects still remains a challenge. Although rental rates have risen substantially over the past two years, they remain well below replacement costs, or what would be needed for new building.

That's the biggest challenge. And think about it: If you expected to have new product delivered today, you would have need to have planned it two years ago, and it was a much different market in the Tampa area then. Now, things are much more robust.

So I think you will start to see one or two new office projects come out of the ground. The first has already begun, with Vision Properties starting work on their Renaissance VI building. That will be a good indicator of the market demand and how fast others may move, how quickly that space is absorbed. So it will be a bellwether for all of the market. I believe there are a couple of fairly major tenants circling the area, and Renaissance is a very popular park, it has great amenities and it's well located. Their new building would accommodate even a large business's operation, too, so all the dynamics indicate it could be snapped up rather quickly.

What about the state of the industrial market? How do you see it performing?

It's very similar to what the office market is experiencing. The activity level there is really through the roof. The biggest challenge is that market supply is very constrained.

A few developers have been willing to build on a speculative basis and have, which is good. But even when those projects are absorbed the vacancy rate will still be in the low single digits.

On top of that, the Amazons of the world are coming into the market and taking down a massive amount of land and space. But the biggest concern is, with distribution space you can sometimes develop a vanilla shell that will accommodate many users, but often industrial space has to be so unique to meet specific tenants' needs.

But overall, I don't think the industrial market here will slow down anytime soon; the current environment is the best I have ever seen. Notably, too, a lot of what we're seeing is organic growth — tenants expanding in mid-lease or adding new space in new markets. Those are both signs of a healthy market.

What about retail? Things are changing rapidly there.

Big retailers have certainly suffered over the past several years, and many retailers are closing all of their stores, which is fairly unprecedented. But what we're seeing is that many centers and malls are being repurposed as trampoline or fitness centers, with medical-related uses and by other nontraditional tenants. From a land play, that makes a lot of sense, because often times retail centers are very well located.

Where do you think the market will be 18 months from now?

I think we're in the middle of the game, about in the fifth inning, to use the baseball analogy. There was some trepidation coming out of the election, but I think that's waned a bit now, and as companies continue to grow, without that previous uncertainty, I think they are going to light up the economy. Unless there's a cataclysmic event, I don't see much getting in the way of that. And we were so far down after 2008 and 2009, and because we slowly rose out of recession, I think we have a much longer runway. With our cost of living, our weather, our beaches — what's made Florida and the bay area popular will continue to fuel local growth.