- July 26, 2024

-

-

Loading

Loading

Defense spending against class action lawsuits has crippled companies' budgets, with a spike in high-risk cases, according to a new report from Carlton Fields.

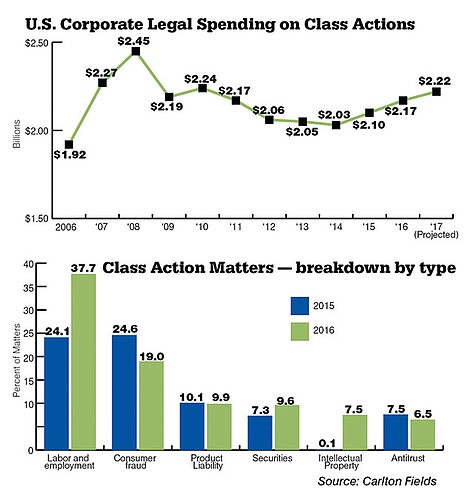

The law firm, with 10 offices nationwide including five in Florida and one in Tampa, recently published the 2017 Carlton Fields Class Action Survey. One highlight: After steadily decreasing expenditures from 2010 to 2014, spending on defense for class action lawsuits rose in 2016 for the second consecutive year.

Companies across multiple industries spent $2.17 billion defending class action lawsuits in 2016, the report shows. That's up from $2.10 billion in 2015 and a decade-low $2.03 billion in 2014. It also accounted for 11.2% of all litigation spending in the United States. The spending uptick occurred even though the percentage of companies that reported facing class action lawsuits on an on-going basis has normalized, from a high of 60.6% in 2015 to 53.8% last year.

“There appears to be a trending increase in the magnitude of class actions, with companies facing increasingly higher risk and exposure,” says Julianna McCabe, director of Carlton Fields' Class Action Survey and chair of the firm's National Class Actions practice group, in a statement. “Understandably, companies are spending more to manage that increased exposure.”

The survey is based on 387 in-depth interviews with general counsel, chief legal officers and direct reports to general counsel of 373 companies. Businesses that participated in the survey, from more than 25 industries, had average annual revenue of $13.8 billion and median annual revenue of $4.9 billion.

From a company's general counsel standpoint, even more alarming than the rise in spending on defense work in class action cases is the actual lawsuits being filed. To wit: the number of companies facing so-called bet-the-company class actions doubled, from 8.3% in 2015 to 16.7% in 2016. Bet-the-company cases are lawsuits that, if the plaintiff wins, could destroy the entire business. Bet-the-company and high-risk cases combined increased from 9.5% in 2015 to 25.3% in 2016, the report shows.

Other survey nuggets include:

Corporate legal departments continue to use fewer in-house attorneys to manage caseloads.

Labor and employment matters displaced consumer fraud as the most common type of class action lawsuit in 2016. Labor and employment now accounts for 37.7% of class actions and 38.9% of spending, the survey reports.

Survey respondents report that wage and hour cases are the most anticipated next wave of class actions, at 25.9%, followed closely by Telephone Consumer Protection Act cases, at 22.2%.