- July 26, 2024

-

-

Loading

Loading

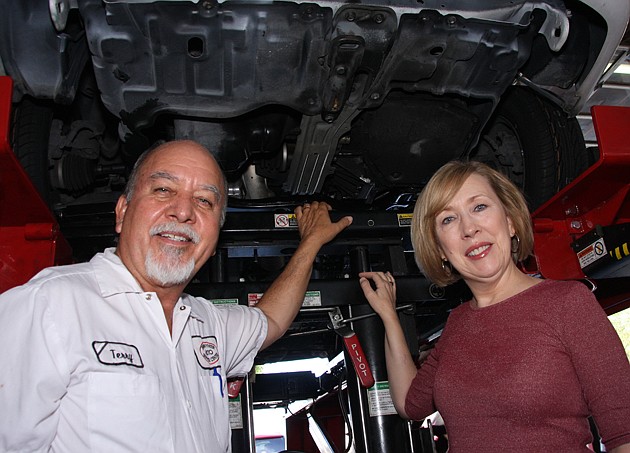

Company: Terry Wynter Auto Service, Fort Myers

Executive: Kay Wynter, co-owner

Industry: Auto repair

Number of Employees: 15

Health insurance challenge: Kay Wynter and her husband, Terry Wynter, have paid 100% of their employees' health-insurance premiums since 2000. “My concern is what this is going to do to our premiums and our ability to continue to offer this,” she says.

When the Wynters first started to pay 100% of employees' health insurance premiums, the cost was about $150 per employee in 2000. Today, it's $446 per employee. Already, the Wynters have had to increase the deductible to keep the premiums from rising even more.

Wynter is worried that government mandates will push premiums so much higher that the benefit will be unaffordable. “Our insurance agent came by yesterday and had his car worked on, and we cornered him a little bit,” Wynter says. “He thinks what's going to happen is that so many small businesses will have to let employees get insurance on their own.”

The financial burden of health care is now squarely on employers. “It's really not fair to the employee or the employer to have the government put so much responsibility on the employer,” Wynter says. “Before, it was a voluntary thing that employers could do for the right reasons. We're just going to have to take it year by year.”