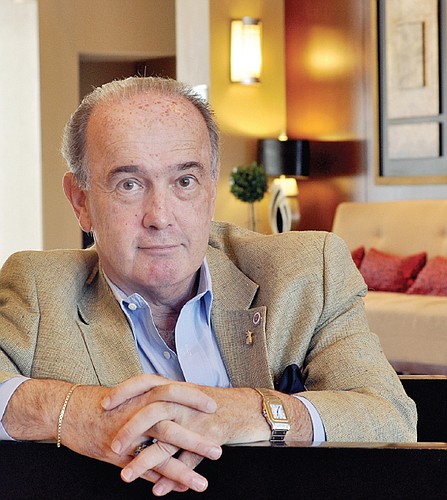

When Fred Hirschovits lectures students at the hospitality school at Florida Gulf Coast University in Fort Myers, he doesn't shy from telling them about his experience.

During the downturn there was nothing glamorous about the hotel business, Hirschovits tells them. After all, the Holiday Inn he owns with other investors near the university opened at probably the worst time in the recession: February 2009.

That area near FGCU and Southwest Florida International Airport experienced a development boom in the mid-2000s that created several thousand new hotel rooms. Multiplied by the 365 days a year, that turns out to be about 1 million room nights. “There's still too much supply,” says Hirschovits, the president of Naples-based Twenty Twenty Worldwide Hospitality. But Hirschovits, 61, says the hotel business is growing again. Occupancies are rising and so are rates. His own company posted revenues of $9 million in 2012, up 12.5% from 2011.

Growth at Twenty Twenty in 2012 came from managing hotels for institutional investors such as private equity funds and banks. For example, the firm is managing two hotels for Terra Cap Management, including the recently renovated La Quinta Inn & Suites in Bonita Springs.

In addition, Twenty Twenty managed and prepared hotels that lenders foreclosed on during the bust. “I took care of their properties while they were preparing them for sale,” says Hirschovits.

One of the encouraging trends Hirschovits sees is growth in both occupancy and rates. For years during the downturn, hoteliers tried to keep their hotels full by slashing the rates. “There's been some growth on both sides,” he says. “When you can grow the rate, the profit margin grows.”

Recent data from the tourism bureaus in Lee and Collier counties confirm this. Revenue per available room, an important financial gauge that is a function of occupancy and room rate, rose 17% in May in Lee County and increased 5% in April in Collier County, according to the latest available data. Discounting still isn't a thing of the past, but it's less widespread now. “There is still some going on in the group business,” Hirschovits says.

And consumers remain bargain hunters. “The challenge is the Internet,” Hirschovits says. “Rate management is done hourly, like gas stations.”

Regionally, Hirschovits says Naples was the first area to see the recovery. “Naples came back strong because there was no new supply,” he says. Building restrictions and other roadblocks impede new development in Naples.

Investors have been scouting the area to buy distressed properties, but Hirschovits says prices have rebounded. “The steals are gone,” he says. “They're close to replacement value.”

But Hirschovits says hotels reaching replacement value doesn't mean there will be a new wave of development soon. Investors are disciplined and lenders are wary, at least for the next few years. “Then people forget,” he smiles.