- July 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

Business. Depend-O-Drain, Anko Products; Bradenton

Industry. Manufacturing

Key. Economic downturn has fueled demand, leading to a new facility.

In many ways, Kent Radovich's 60-employee laundry machine valve manufacturing business is rinsing through an enviable cycle.

The operation includes two Bradenton-based companies, Depend-O-Drain and Anko Products, in addition to Miami Lakes-based Industrial Plastic Products. All the companies are part of Jln Holdings LLC, which Radovich owns.

The cycle of fortune the companies are washing through is manifold. For starters, most of the local companies and parts of the Miami Lakes business will move into a new facility in Manatee County later this year. The combined companies, moreover, have at least $10 million in annual sales, a figure that's been on the rise the past few years. Radovich even added 10 people to the payroll in 2011.

And, significantly, in a paradoxical twist to the recession, fewer people owning or buying homes is a boost to the business. That's because fewer homeowners means more people using laundromats, and the manufacturers of laundromat-based washing machines are niche markets for Radovich's businesses.

“There have been some favorable trends that allowed us to escape with our hides through the downturn,” says Radovich. “We think the future is pretty bright.”

Perfect place

One big piece of the strategy is the complex the company bought last year as part of an ambitious expansion plan. The property has two buildings, one 12,000 square feet and another 15,000 square feet. A truck well connects the buildings. Cadmold, a mold injection firm, last occupied the space.

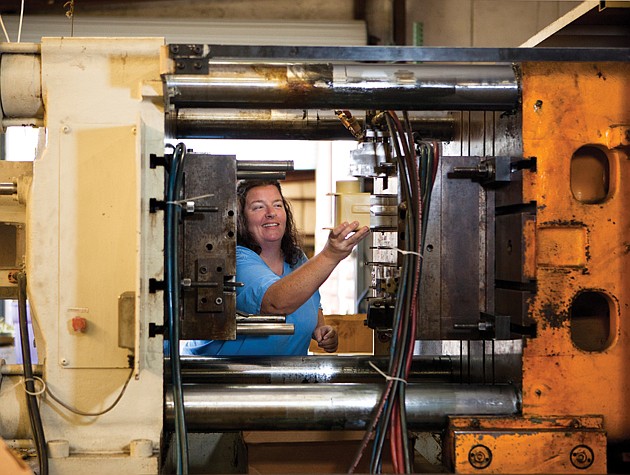

Radovich's businesses paid $695,000 for the buildings, or $26 per square foot. The buildings have sat unoccupied for two years, but both the layout and the price lured Radovich. The ceilings, for one, are high enough to fit his machines and equipment. Anko Products has 10 injection-mold machines that when new, cost about $75,000 apiece.

“We couldn't have built it or designed it any better,” Radovich says. “It's perfect for us.”

The price was also right. In fact, Radovich says it would have cost about $60 a square foot to build a new plant on five acres the company owns next to its current facility. Wells Fargo financed the purchase.

The new space will provide room for all the businesses Radovich runs to make more of its specialty — drain valves. Depend-O-Drain will custom-manufacture products for clients, but it mostly makes drain valves that fit into laundry machines and dishwashers.

The Anko Products side of the operation, meanwhile, manufactures plastic parts, some of which are used in Depend-O-Drain products. Says Radovich: “Anko and Depend-O-Drain have an extremely symbiotic relationship.”

Finally, Industrial Plastic Products focuses on plastic injection molding. It also makes drain valves and plastic pump pieces that Depend-O-Drain and Anko Products use.

A majority of the sales for the entire operation, 90%, are to firms outside Florida, Radovich says. International revenues have also increased lately, to the point where in 2011 it represented about 33% of all sales. The firm even recently sold a shipment of washing machine drain valves to clients in the Czech Republic.

While the laundromat side of the business is big moneymaker for the companies, Radovich would like the operation to become more diversified. “Our growth plan going forward,” he says, “is based on expanding (all) product lines.”

'Exciting and challenging'

The potential to expand the product line will soon translate to more employees, layers and departments, says Radovich. Two areas he would like to see more growth in sooner than later are central purchasing and quality control.

“As our revenue base gets higher, we can create more silos,” says Radovich. “It gives us the opportunity to fill in the blanks.”

One challenge on the production side is common to many Gulf Coast manufacturers: finding the right employees. Radovich says the product designers and mechanical engineers he seeks are rare. “There's not as many of them as there were 10 or 20 years ago,” he says.

Radovich worked in banking in Chicago back then, where he was a commercial lender. A business broker told him about Depend-O-Drain in 2004. He bought that business, and in 2010, he acquired Anko Products. He also bought Industrial Plastic Products, which was under different ownership.

Radovich longed to go from the theoretical side of running a business to the practical side. “I went from just looking at numbers to being an entrepreneur,” Radovich says. “I was always intrigued with small business owners.”

Bradenton businessmen Bob Hartshorn and Barney Edwards founded Depend-O-Drain in the early 1970s. The company initially sold drain valves for laundry machines and dishwashers, mostly to European manufacturers. Hartshorn co-founded Anko Products, too, which was staffed with engineers who worked on motors for valves.

Many of the products' functions and composition remain the same nearly four decades later. The operation still goes through a good amount of resin and copper, Radovich says. And just like it was in the early stages, some challenges stand out. The cost of materials and energy are big concerns for Radovich, as are the worries regarding changing the federal tax structure.

Radovich is nonetheless confident the firm will succeed in its growth mission, despite the hurdles. “This is a good old-fashioned manufacturing operation,” says Radovich. “It's an exciting and challenging time coming up for us.”

SIDEBAR: TAX MAN COMMETH

Despite promising potential, Kent Radovich is braced for a bruising 2012 and beyond. One major culprit, he says, is the federal government. Specifically, Radovich says any income tax hike imposed by Congress, through President Barack Obama's initiatives, could wreck his growth plans.

Indeed, how Radovich navigates one of an entrepreneur's greatest nightmares — uncertainty caused by the government — will play a big role in the company's future. “I want to use all the tools I have to keep people employed,” says Radovich. “But the government isn't helping. They are the biggest hindrance.”

Radovich is prepared to get walloped on taxes from what he calls the class warfare game being played in Washington, D.C. Radovich says the much-discussed so-called millionaires and billionaires proposal, to increase the tax rate on filers who earn more than $250,000, would be a direct assault on his businesses.

That's partially because the businesses are part of an S corporation, where losses, deductions and income are passed through to shareholders. It means Radovich, the majority owner, would be on the hook for the bulk of any tax hike.

So, according to Radovich, the benefits of being an S corporation, to bypass double taxation, will evaporate if and when the tax rate goes up. The consequence, he adds, is the more money he sends to Washington, the less he will spend on research and development, hiring and purchasing equipment.

“The folks in Washington don't get it,” says Radovich. “They are playing class warfare and that just doesn't work. It's extremely frustrating.”