- July 26, 2024

-

-

Loading

Loading

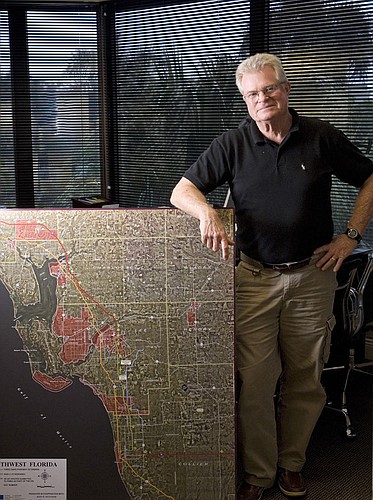

In a presentation to the Collier Building Industry Association recently, land broker Ross McIntosh drew gasps when he showed a slide with this headline: Our Incredible Shrinking Universe.

In 2008, the slide showed, there were 252 builders in Lee and Collier counties. This year, the count is 108.

But as bad as the last five years have been for residential builders and developers, Collier appears to be poised for a recovery. McIntosh's conclusion: “My impression is the worst is behind us,” he says.

McIntosh points to several reasons for optimism:

• The top 10 builders in the area have pulled twice as many single-family building permits so far this year compared with all of 2010.

• Private-equity firms such as Angelo Gordon and Mount Kellett Capital Management have invested millions of dollars buying existing developments at a discount.

• Cameratta Development recently sold community development district debt for a new residential community.

• Upscale homebuilder Toll Brothers is planning a new residential development.

“Suddenly, there are development deals,” says McIntosh. “We haven't seen a project started from scratch in five years.”

The spread between buyers and sellers of residential land has narrowed, McIntosh says. In particular, banks are now better equipped to deal with land they've acquired in foreclosure with their newly formed special-assets divisions. “Now there's a method,” says McIntosh.

Naples-based Stock Development is among the pioneers of this new wave of development with two new projects in Naples on land the company acquired from banks that foreclosed. Others include large publicly traded homebuilders such as Lennar, which is acquiring the failed Treviso Bay development in east Naples after Wachovia foreclosed on the property.

Most of the land deals so far have been financed by private equity, but McIntosh pointed to the reemergence of community development district debt as a positive sign. With this kind of financing, a developer sells bonds to investors to pay for roads, sewers and other infrastructure. But the collapse of the residential real estate business also resulted in substantial investor losses, and this form of financing has been nonexistent until now. “The documents are written differently now,” says McIntosh. “The disclosures are in larger print.”

McIntosh cited data from market tracking firm Metrostudy that indicates there is only a two months' supply of finished vacant homes in the Lee and Collier areas. “We need to build some lots,” he says. “One builder has told me they're able to raise prices.”

McIntosh isn't overly concerned about foreclosures. “It's no longer the assault that is used to be,” he says. Banks are managing foreclosures better, making deals with borrowers where it makes sense and expediting short sales.