- July 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

Company. Naples Beach Hotel & Golf Club

Industry. Hospitality

Key. Invest in the business to gain more market share.

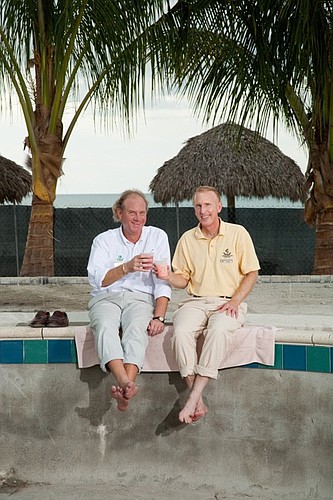

To get a sense of why The Naples Beach Hotel & Golf Club has been so successful over the years, take a stroll of the manicured grounds with owner Michael Watkins.

Every few feet, Watkins, 56, stoops to pick up the tiniest bit of trash. He spots a cigarette butt or a gum wrapper like an owl spots a mouse. He runs his fingers over cupboard ledges in the bedrooms to see if they're dusty and makes sure the window shades are perfectly spaced three fingers apart. He scribbles in his notebook when he finds something amiss, guaranteeing someone will hear about it.

For Watkins and his brother Henry Watkins III, 58, the third generation of owners of the beachfront hotel, everything is at stake. Since 2000, the family has spent more than $55 million on new buildings and renovations of existing facilities. Of that sum, they spent more than $16 million to renovate all 319 rooms and suites and another $5 million for a new pool complex that will open next month.

The Watkins family has made these investments despite all the challenges that have been heaped on them since 2000. These included the terrorist attacks of 2001, the hurricanes of 2004, stiff competition from new hotels such as the Ritz-Carlton and now the worst recession in decades.

“It's been bad. It's been terrible,” Watkins says. In the same breath, he adds: “We've taken advantage of that to invest in the business.”

Watkins says the family borrowed money when credit was easier to obtain a few years ago on good terms, though he declines to be more specific. “We had a good balance sheet,” he says.

The family has owned the 125-acre property since 1946, giving it such a low basis that Watkins says the family could still borrow the money in today's tight credit markets despite the downturn in real estate values.

Certainly, no one foresaw the depth of this recession.

Revenues per available room, an important financial gauge that combines occupancy and room rates, have dropped nearly 21% in the Naples area this year through October compared with the same period in 2008, Smith Travel Research reports.

“We didn't expect the decline in business, but we went ahead anyway,” says Watkins, who declined to discuss the hotel's recent financial performance. The renovations were necessary to compete with luxury rivals and will give the hotel ammunition to gain market share, he says.

Battling the chains

While the Naples Beach Hotel's principal customer is the leisure traveler, its corporate business has grown with the addition of a spa and additional meeting rooms overlooking its 18-hole golf course.

The corporate business, which represents about 40% of the hotel's revenues, slowed considerably in the downturn as companies cut back on travel.

While the corporate business hasn't recovered, the few companies that still budget for travel are choosing the Naples Beach Hotel over the Ritz-Carlton, Watkins says. Some of that may be because of the so-called AIG effect, when the government chastised the insurance company for entertaining its best customers and rewarding employees at luxury resorts. “We're low-key and casual,” Watkins says.

And just because it's family owned doesn't mean the Naples Beach Hotel can't be more aggressive than its corporate competition for group business.

For example, Director of Group Sales David Tyler created a program where corporate-travel managers could cash a $5,000 check made out to them if they arranged for at least $50,000 worth of business. Over 60 meeting planners have called him about claiming the check since it was mailed to them earlier this year.

“We're still getting calls,” says Tyler, who expected only a handful would respond.

But competition has been ruthless as nearby resorts slash rates to fill their hotels. For example, the nearby luxury Naples Grande Beach Resort lowered its rooms to $79 a night. “You can't compete with that,” Watkins shrugs.

What's more, the booking window has become narrower, making it difficult to plan for large gatherings. Groups that used to plan a year ahead are now calling about events they want to plan within two months or less. “That's pretty wacky,” Watkins says.

On the leisure side, the booking window is even shorter. This summer, for example, many Europeans showed up without reservations despite the distance they traveled.

Rebound in 2011

Watkins is confident the leisure travelers will return during the busy winter months. That's because the stock market is a good predictor of how people feel about taking a vacation, he says. The Standard and Poor's 500-stock index, a gauge of large-company stocks, is up more than 20% this year.

But the short-term booking window does make it difficult to gauge the demand. That pattern distorts any forecast. For example, the month of May is now the fullest while Watkins says there's “room to grow” in March.

Pricing is difficult because of that short booking window. “It's really a day-to-day thing,” Watkins says. On the group side, meeting planners scrutinize costs. “It's all about the value,” Tyler says. “It used to be we'd quote $300 a night and they wouldn't flinch.”

In the meantime, the hotel has been able to trim costs without affecting service. For example, the relatively high unemployment rate in Collier County means the hotel won't have to recruit labor from the Caribbean or Eastern Europe during the busy winter months.

The hotel has cross-trained employees to do multiple jobs. For example, an administrative assistant in the corporate office also manages the business center. The hotel has eliminated overtime even as it has left some positions unfilled.

To generate additional revenue, the spa and restaurant offer gift cards geared to local residents. “We sell them all over the hotel,” Watkins says.

The key is to manage through 2010 to a better year in 2011.

Watkins says he's most concerned about the group business. He frets that many corporations have switched to new technology to link workers and their customers instead of travel. Conferences held by video is a particular concern.

“Is that the wave of the future?” Watkins wonders aloud. “That will affect all of us.”

Jean Gruss covers the Lee-Collier region. He can be reached at [email protected], or at 239-415-4422