- July 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

Name. John H. Sykes

Importance. Influential business leader and philanthropist in Tampa for nearly two decades

Companies. JHS Capital Holdings Inc., Sykes Enterprises Inc., NorthStar Banking Corp., Cloverleaf Farms II Inc., Woodford Thoroughbreds LLC

Key. Continue building companies, return ethics to financial advisory services

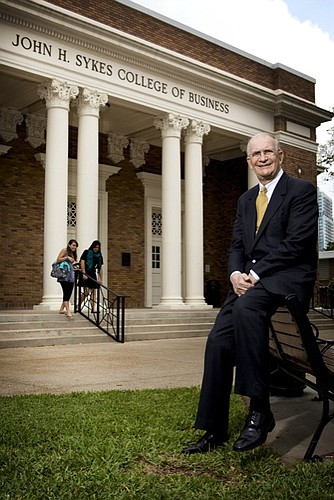

John H. Sykes always seems to be in building mode. He turned Sykes Enterprises Inc. into a worldwide computer technical support company after moving it in 1993 to Tampa from Charlotte, N.C., his surname is emblazed on the city skyline and soon there will be two buildings at the University of Tampa named in his honor.

When you're 73 years old and have your own private hangar at Tampa International Airport with two Gulfstream jets, you might be inclined to sit back and let things happen around you after working so hard to get to that point. Yet Sykes doesn't appear to be ready to stop anytime soon.

Enter his latest venture: JHS Capital Advisors, a new asset management firm that places a premium on ethics, integrity, transparency, full disclosure and personalized client service. Sykes formed the company in December after acquiring Pointe Capital Inc.

Sykes, who rarely grants interviews to the local media, tells the Gulf Coast Business Review that now is the right time to launch such a firm, given the current protracted “long U” economic recovery as well as consolidation and reorganization within the financial services industry. He is confident that JHS Capital can attract veteran financial advisors who have become disenchanted with the direction of their current wire houses along with having to prioritize selling their branded products.

“It presents a tremendous opportunity for us to be able to recruit and attract people to a new entity that allows them to come in as an independent or join us as an employee,” Sykes says. The firm's primary focus, he says, will be to serve all customers — not just those with higher net worth -- in the best possible fashion, offering the best fund options.

Sykes adds that JHS Capital won't promote its own branded investments: “We just don't think that serves the best interests of our clients or gives them the broadest perspective.”

One company, two firms

Now 130 brokers strong, JHS Capital is divided into two sets. Paul Richardson, former owner of Pointe Capital, is president of its retail and institutional investment group, while Mary Kennemur, former senior vice president of Merrill Lynch's Southeast region, is president of the firm's fee-based wealth management services.

“We just feel that in the economic conditions we have now, there are people in that mid-cap area that need attention as well,” Sykes says. “As we move into our changing economic times, more people are going to want more fee-based managed care,” taking care of things like credit cards, college tuition and mortgage payments.

Although JHS Capital has a goal of 500 advisors in the next five years, Sykes emphasizes that brokers will be required to maintain strict in-house standards reflecting the firm's integrity.

“We're not going to take anybody just for the sake of growing revenues,” he says. “We want to be more of a qualitative-based company that always puts the customer first.”

Of course, he adds, there are no guarantees that JHS Capital wouldn't wind up hiring someone that could come back to bite the firm later where regulators are concerned. “I don't know of any company that is totally, absolutely perfect, and in this business you're going to have some issues,” Sykes says.

About three dozen of JHS Capital's newest brokers came over from GunnAllen Financial Inc., a Tampa-based brokerage that was shut down in March after falling below net capital requirements. Sykes was GunnAllen's chairman until abruptly stepping down in December and later forming his own firm. He declines to comment on the former company, simply saying, “I've put all that behind me.”

'Right people on the bus'

Sykes notes that he will not be involved in the day-to-day activities of JHS Capital since he is not a licensed broker, but only as an investor and chairman of JHS Capital Holdings Inc. He says Scott Bendert, former chief financial officer at GunnAllen, is in the process of obtaining his new license as chairman and CEO of JHS Capital Advisors.

“It's a matter of making sure you've got the right people on the bus and the right platform,” Sykes says. “We believe we have assembled the best team to start us in that direction.”

Among others joining JHS Capital earlier this month is LCM Capital Advisors, a Sarasota-based firm specializing in high-net-worth portfolio design and asset protection strategies managing approximately $100 million in retail and institutional assets. Jon Lee, Keith Curtis and Robert Melberth are the team's leaders.

“We strongly believe in JHS's founding principles and are guided by the same commitment to ethics and client service,” says Lee, LCM managing partner.

Sykes also takes an arm's-length approach to Sykes Enterprises, for which he has served as chairman emeritus since 2004. His son, Charles Sykes, is president and CEO and he remains observant of the company's progress as one of its largest investors, but without trying to cast a shadow.

“They have done a remarkable job,” Sykes says of the billion-dollar company headquartered at Rivergate Tower in downtown Tampa and listed on the New York Stock Exchange. “I'm very pleased and have a tremendous amount of pride for my son, but I am also proud that the board is the same one that I assembled myself.”

Faith-based development

Beyond the world of business, Sykes' latest project touches on his spiritual side. The $20-million Sykes Chapel and Center for Faith and Values at the University of Tampa is expected to be completed later this year and will be highlighted by a 75-foot music tower that will become as recognizable a campus landmark as the spires of the historic Tampa Bay Hotel, now known as Plant Hall.

An organ with 3,184 pipes will be installed inside the 12,750-square-foot facility, which will also include a meditation garden, meeting rooms and private worship spaces. Sykes says even though Christianity is the dominant religion on the UT campus, others must also be respected at the private liberal arts university whose students come from more than 100 countries and all 50 states.

“The students are really excited about it and it's also gathering a tremendous amount of inquiries and interest from the community,” he says. “It's going to bring a lot of attention to the university, and to the city, in a good way.”

Sykes says his affinity to the University of Tampa, where the business college and ethics center also bear his name, stems from the fact that the campus is so closely connected to the city, right across the Hillsborough River from the central business district. The huge University of South Florida garners more national attention, he says, but its Fowler Avenue campus is so remote from Tampa's core.

“There is no great city without a great university in its midst,” he says. “It's important that we build the university in the right way that represents our city.”

As the Gulf Coast region's closest answer to Warren Buffett, John Sykes commands the attention of the local business community whenever he speaks. He warns right away, though, that not everyone will be inclined to agree with him.

“I'll answer any question you have, but you may not always like the answer,” says the Tampa businessman and philanthropist, whose guidance and counsel are often sought in major city endeavors. (Remember Tampa's bid for the 2012 Olympics? Sykes was asked to chair that effort.)

At the request of the Gulf Coast Business Review, Sykes was asked to share his thoughts on a few current issues affecting the future of the city and region. Here are his edited comments:

• Economic development: “We're not going to come out of this downturn for some period of time, unfortunately. There are only three ways a city or business can emerge from a bad economy — build revenue, reduce costs or a combination of both. Businesses increase revenue by expanding. Cities have to raise taxes.

“Our community seems to sit back and wait for someone to show us interest, then go after them. We need to do what businesses do. We need planning — what kinds of business do we want, what do we want to be known for? USF has a strong medical component, so let's focus on that.

“Businesses today are trying to determine where they can go to reduce operating costs. Why not here? We don't have personal income tax, our housing is affordable and with 12% unemployment we have an available work force.”

• Local leadership: “I'm not too sure that the people of the greater Tampa Bay area are being realistic. Without expanding our business base, we are going to have to consider some additional taxes or fees. It may force our cities and counties to come together and impose regional taxes.

“We may need to consider consolidating our local governments, which has worked well for Jacksonville and other cities. I know that's not popular.

“We need leaders who can embrace new ideas and new thoughts, and be able to be a good salesperson for our community. We have a very narrow thinking in this area that if something is going to be in Hillsborough County, then Hillsborough County ought to pay for it. It's going to require new thinking as we move forward.”

• Rays stadium proposal: “What difference does it make where the baseball stadium is built? The entire region benefits from games. Football fans stay in Pinellas County even though those games are played in Tampa.

“It should be built in a downtown environment, and it should be built in Tampa. Studies have shown that large numbers of people from Tampa go to games. We also need hotels and restaurants within walking distance of the stadium. Accessibility is important.

“What it comes down to is not the best interests of Tampa or St. Petersburg, but those of the baseball team.”

• High-speed and light rail: “I'm a train buff, I love trains. I think we stick our heads in the sand if we continue to say we don't need rail as a means of transportation.

“We have a megalopolis forming along Interstate 4 (between Tampa and Orlando) and we will need something to tie it together. We've seen how commuter rail has worked in other parts of the U.S. and in Europe. What makes us think it won't work here?

“Rail might not serve this area in my lifetime, but you have to start planning for it long before you really achieve the benefits — and you need to be willing to pay for it.”