- July 26, 2024

-

-

Loading

Loading

To get a gauge on the future of Health Management Associates, consider the unemployment line.

As more people lose their jobs, they're less likely to have health insurance or the means to pay for a stay at one of the Naples-based company's 56 hospitals. How much worse the unemployment situation will get could determine HMA's fate.

That's put more pressure on Gary Newsome, HMA's third president and chief executive officer in as many years. In the relatively short eight months that he's been at the helm, Newsome has cut expenses, improved emergency room operations to boost admissions and kept HMA's creditors at bay.

Newsome was unavailable due to an illness, but there are signs that his initiatives are starting to pay off. For example, HMA reported a 3% increase in net revenue per admission in the first quarter compared with the same period a year ago, despite a tough economy.

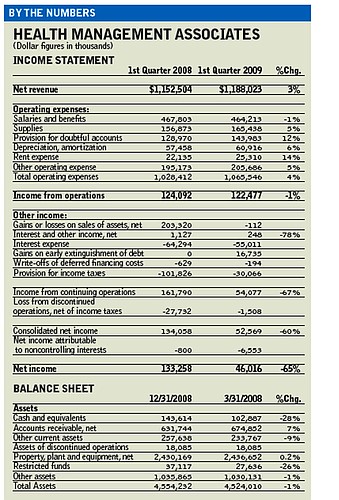

Still, people who can't pay their bills weigh heavily, especially since the hospitals can't turn them away. The sum of bad-debt expense, uninsured discounts, charity and indigent write-offs at HMA totaled 23.8% of net revenues, compared with 22.7% for the same quarter in 2008. The company's provision for doubtful accounts rose 12% in the first quarter of 2009 to $144 million from the same quarter a year ago.

The big concern is that cost-cutting and operational improvements won't be enough to stem an overwhelming increase in uninsured patients who can't pay.

“That's why we still have a bankruptcy scenario,” says Jeffrey Stafford, a Morningstar analyst who estimates that HMA has a 40% probability of being forced into such a situation.

HMA has $3.1 billion in long-term debt. The company leveraged its balance sheet when it decided in early 2007 to borrow $3.25 billion in part to pay a special dividend of $10 a share to shareholders.

HMA's net income was $46 million in the first quarter of this year, a 65% drop from the same period a year ago. However, results from the prior year's first quarter included a one-time $203-million gain from the sale of a 27% interest in seven hospitals to Novant Health.

HMA is still one of the best hospital operators around. By focusing on rural areas where it can dominate, HMA exceeds its peers on most measures of profitability, according to Morningstar analysis.

But if HMA's hospital admissions fail to grow and bad-debt expenses balloon, they could trip the company's covenants with its lenders. “As long as they don't violate their covenants, then they're fine,” Stafford says. Even if they do, lenders are likely to give the company leeway, he adds.

In an earnings call with analysts on April 28, Newsome and HMA Senior Vice President and Chief Financial Officer Robert Farnham outlined the steps the company is taking to improve operations. They also suggested that the level of uninsured patients wouldn't get much worse.

For one thing, state and federal government stimulus programs could pick up the slack.

For example, state health insurance programs for low-income families have been expanded and the federal government provides a tax credit for health insurance to those who recently have been laid off. HMA has become more aggressive about making sure it gets paid, such as demanding upfront payment from non-emergency patients.

And HMA is working on containing big costs such as labor. For example, it recently suspended it 401(k) match and told employees there would be no merit raises this year. As a percent of net revenue, hospital salaries, wages and benefits fell to 37.3% in the first quarter from 39.1% in the same period a year ago.

In addition, the hospital has instituted a new emergency room patient-tracking system that improves the flow of patients by reducing the amount of time they spend in the ward.

Newsome, who refers to the emergency room as “the other front door,” told analysts that the new system is beginning to show that patients are spending less time in the emergency room.

The less time people spend there, the happier they are and the more patients the hospital can help.

“We believe the volume improvements we have seen this quarter and in the fourth quarter 2008 are partially attributable to our focus on the ER operations,” Newsome told analysts.

In its two biggest markets, Florida and Mississippi, HMA's growth in paying patients outpaced the growth of uninsured patients.

That's despite the fact that those two states have been hit hard by the recession. Newsome attributed improvements in the emergency room to helping HMA gain market share in these two states.

In the end, however, forces beyond HMA's control could dictate the future of the company. “The economy continues to be the wildcard,” Newsome says.

HEALTH MANAGEMENT ASSOCIATES

Headquarters: Naples

Annual revenues: $1.2 billion

Chief executive: Gary Newsome

Stock symbol: HMA

Recent stock price: $4.68

52-week stock price high/low: $8.20/$0.79

Web site: www.hma.com

Source: Google Finance