Something is growing, albeit faintly, in the banking industry, and for the first time in a decade it's not a tree of regulation.

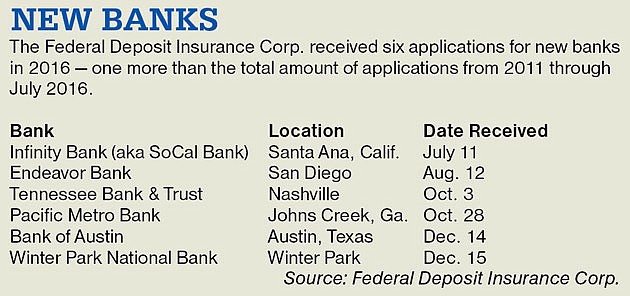

Instead, this time, what's growing is applications from investor groups that seek to form new banks, also known as de novo banks. Federal officials have received six applications in the last nine months for startup banks, including one, Winter Park National Bank, in Florida, according to Federal Deposit Insurance Corp data.

While miniscule, the six applications are a relative boom compared to the five new bank applications the FDIC received from 2011 through July 2016. The Winter Park National Bank application is pending, as are the others. (State and federal agencies charter banks; the FDIC approves deposit insurance, so the agency's backing is essential for any new bank.)

In April 2016 FDIC officials slashed the years a bank is subject to stringent de novo capital regulations to three, from seven. The timeframe had been three years, but was bumped up to seven years in the recession. Federal officials credit the recent decrease, in addition to some other relaxed rules, with stoking a renewed interest in startup banks.

But for some bankers, the uptick is too small to get excited about. For example, in March 21 Congressional testimony, Texas banker Ken Burgess, chairman-elect of the American Bankers Association, says the industry remains stuck in regulation purgatory.

“The lack of de novo activity is concerning to our industry and sadly reflects the same forces that are driving consolidation — excessive and complex regulations that are not tailored to the risks of specific institutions,” says Burgess, chairman of Midland, Texas-based FirstCapital Bank. “This — not the local economic conditions — is often the tipping point that drives small banks to merge with banks typically many times larger and is a barrier to entry for new banks.”