Rock Creek Pharmaceuticals, which moved from Virginia to Manatee County in June 2014 with a plan to develop drugs and medications for inflammatory conditions, neurological diseases and behavioral health, has filed for bankruptcy.

The company, in addition to a pair of subsidiaries, RCP Development Inc. and Star Tobacco Inc., filed for Chapter 7 bankruptcy Sept. 27, according to a Securities and Exchange Commission filing. Chapter 7 is commonly used for liquidation.

Rock Creek, according to its SEC bankruptcy filing, reported total assets of $35,139 against total liabilities of $21.3 million. RCP Development reported total assets of $31,308 and total liabilities of $51.9 million and Star Tobacco reported total assets of $482,289 and total liabilities of $12.2 million.

The firm, formerly named Star Scientific Inc., leased space from the Manatee County-based Roskamp Institute, a nationally recognized organization that studies diseases of the mind. Rock Creek, when it relocated to town in 2014, intended to create at least 16 high-paying jobs by 2019, in return for $48,000 in performance-based incentives that Manatee County officials approved.

But most of those jobs never came to fruition.

The company, instead, struggled to bring its products to market. Part of the problems, according to 2015 interviews with company executives, were legacy issues: When the company was Star Scientific and based in Virginia it faced FDA charges of inaccurate marketing on its products, including Anatabloc, an anti-inflammatory product that supports the immune system. Other problems stemmed from investigations into relationships between the Star Scientific founder and a former Virginia governor.

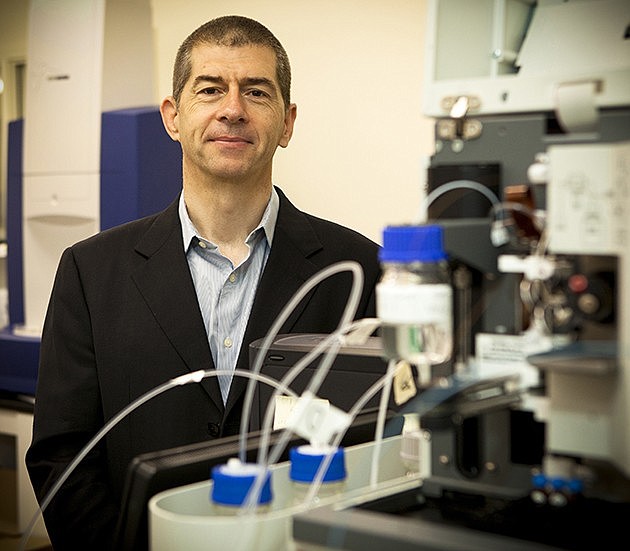

More issues came from being in the notoriously tough pharmaceutical industry, where investments are high and a big payoff can be rare and slow to develop. “Everyone knows this is risky,” Rock Creek President and CEO Dr. Michael Mullan said in a 2015 interview with the Business Observer. “We spend a lot of time thinking about how to de-risk it.”

Rock Creek has had several years of big losses, going back to 2012. And it issued several statements earlier this year in regard to notices of defaulting on its debt. In August company officials, in a statement, said the firm was “exploring a variety of additional financing options as a supplement or replacement for” some of its debt notes.