Just how good they are sometimes depends on a client's appetite.

That's because FineMark has an on-staff chef and a sous chef at its Fort Myers headquarters, in addition to another chef at its Coconut Road branch in Bonita Springs. The bank is even renovating an office in Naples to make room for a kitchen and chef there.

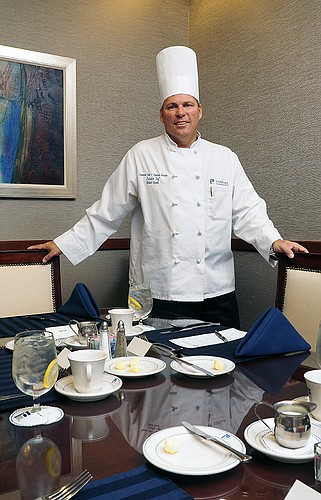

FineMark's head chef is Michael Gavala, also an associate vice president at the bank. A graduate of The Culinary Institute of America, Gavala serves breakfast, lunch and dinner to clients who come by to chat with bankers about deals, loans and other business. All menu options, from fresh-caught fish at lunch to wine pairings at dinner to Key lime pie for dessert, are free for clients or potential clients invited by a manager or executive.

And there's more: The bank occasionally brings out an ice sculpture for special events.

“It obviously costs a lot of money to do this, but we feel it's worth it,” says Jessica Stilwell Catti, FineMark client services manager and marketing director. “It's not a moneymaker, but it's a relationship builder. It separates us from other banks.”

It's also one of the more unique ways a community bank on the Gulf Coast spends money to make money, part of its strategy to grow non-interest income. That's where banks make money in ways outside the core business of commercial loans. Non-interest income can include insurance products; fees on a range of services; SBA loans; wealth management and trust; and residential mortgages. A home mortgage, while a loan, is traditionally a one-time borrowing event, so money made off it counts under non-interest income.

Non-interest income has always been important to banks. But the metric, of late, has taken a heightened importance, say multiple Gulf Coast bankers and industry analysts. For one, low-interest rates and high competition from local, regional and national banks have choked a bank's profits from loans. “Everyone is looking at ways to increase non-interest income,” says St. Petersburg-based Freedom Bank of America President and CEO Cathy Swanson. “But it's a big challenge.”

Also, net interest margin, the difference between a bank's income and the amount of interest paid to its lenders relative to assets, has been in downward compression for several years. That too leads a bank back to non-interest income, to find alternative ways to make money. “Net interest margin is under pressure,” says Joe Chillura, president and CEO at Largo-based USAmeriBank, a $2.9 billion asset lender. “So non-interest income is key.”

'Right players'

Challenges in non-interest income, say a host of bankers, stem partially from the expenses it takes to do well and outcompete in a non-core area. Regulations also play a significant role in a bank's decision to pursue a certain non-interest income strategy, or whether it pursues a strategy outside of loans at all.

Fort Myers-based Edison National Bank, for example, a $248.5 million asset institution, doesn't have an aggressive non-interest income approach. “We've never been one to say let's get into insurance or let's get into something else,” says Edison President Robbie Roepstorff. “We are bankers.”

That doesn't mean Edison, with four branches, including one on Captiva Island and one on Sanibel Island, doesn't have any non-interest income. The bank had $555,000 in non-interest income through the second quarter, according to Federal Deposit Insurance Corp. data. That's up 13.73% from the second quarter in 2013, when the bank had $488,999 in non-interest income. Roepstorff attributes the gain mostly to real estate sales.

Sarasota-based Insignia Bank, like Edison, doesn't put a large emphasis on non-interest income. The bank has an investment division, Insignia Investments, where it generates some fees, says Insignia CEO and Chairman Charlie Brown. But most of the bank's non-interest income is from residential mortgages. The bank had $427,000 in non-interest income in the second quarter, FDIC data shows, a drop of 18.67% over 2013, when it had $525,000. “We are a loan-driven bank,” says Brown, “and we will continue to be a loan-driven bank.”

Swanson, at Freedom Bank of America, with $111.1 million in assets, concedes the bank could be better in non-interest income. Improvement in that area is a goal she has for 2014 and 2015. One obstacle, she says, is finding the right people to run non-interest income divisions, such as an SBA loan executive. “We haven't found the right players,” says Swanson.

Freedom Bank of America, through the second quarter, has one of the smallest non-interest income totals of all 40 Gulf Coast community banks. That total is $102,000 through the second quarter, according to FDIC data, up 37.84% from 2013, when it posted $74,000.

“I wish I could say we had some sexy product we are pushing for non-interest income,” says Swanson. “It's on my to-do list.”

Longtime strategy

Other banks in the region are more proactive in non-interest income.

FineMark is one of those banks, and not only because of its appetizing meals. The bank has robust trust unit, says FineMark Executive Vice President and CFO Brian Eagleston, in addition to other non-interest income services. The moves have paid off: Non-interest income at FineMark is up 76.57%, from $2.83 million in the second quarter of 2013 to $5 million through June.

Port Charlotte-based Charlotte State Bank & Trust, a unit of Wauchula-based Crews Banking Corp., is also in the proactive camp. Charlotte State Bank & Trust has had a trust division since 2004, says Michael Aloian, president of trust and investment management services and the chief investment officer. The division has 10 employees, and has grown steadily over the last decade. Marketing and brand awareness has been a big challenge. That's why the bank added “& Trust” to its name in 2012. Says Aloian: “A lot of people didn't even know we had a trust until we put it in our name.”

Charlotte State Bank & Trust posted a slight dip in non-interest income in the second quarter, down 4.14% over 2013. But at $1.9 million in non-interest income through June 30, the bank is a leader in the region. “(Trust services) is a very specialized area that a lot of banks don't want to get into unless they have the expertise,” says Aloian. “It's a way for us to differentiate ourselves.”

Some banks in the region have had a non-interest income strategy since before there was even a bank. Shaun Merriman, with Sarasota-based Gateway Bank of Southwest Florida, had a non-interest income strategy in mind when he founded the institution in 2008.

The bank's goal, basically, is to become a single-source supplier of financial services, including wealth management. Gateway also has a home lending unit. “While we don't employ a 'hard sell' cross-selling sales strategy, we do strive to position our bank as the only bank our customers need,” says Merriman. “This is just good business, and by having a broad range of products we deepen our relationship with our customers beyond the nuts and bolts business of gathering deposits and making loans.”

Another bank that's concentrated on non-interest income for years is St. Petersburg-based C1 Bank, especially through its SBA lending program, one of the largest in the region. That SBA focus, says C1 CEO Trevor Burgess, goes back to when the bank was primarily a Manatee County lender. Non-interest income at C1 Bank increased 65.61% in the second quarter, from $2.17 million in 2013 to $3.6 million.

“We have a focus on the business owner,” Burgess says, “and so many entrepreneurs in Florida fit into the SBA program.”

EXECUTIVE SUMMARY

Industry. Banking Trend. Banks in the region seek strategies to grow non-loan income. Key. Competition and regulations are some challenges in expanding non-interest income.

ALL IN THE ATTITUDE

Bankers who seek to boost profits through non-interest income by finding alternative revenue sources outside of loans have run into a familiar foe: regulators.

A handful of community bankers on the Gulf Coast, when asked about non-interest income strategies, say they are extra cautious due to a host of regulations. The federal Dodd-Frank financial reform bill, passed in 2010, tops the list. The bill created the Consumer Financial Protection Bureau, which several bankers consider a major overreach.

But Joe Chillura, president and CEO of Largo-based USAmeriBank, has an approach to regulations that could serve all bankers well. Chillura says the best move is to adjust to reality. “It's the new normal,” says Chillura. “To sit here and whine about it won't do anyone any good.”

**Notes

Several Gulf Coast banks posted large gains or losses in non-interest income in the second quarter compared with the same quarter in 2013. Some banks with big percentage drops or gains involved small sums of money. In those cases, bankers cited volume increases in deposits for reasons the bank was up or down. Other bankers pointed to more specific causes. Those included:

Sabal Palm Bank, Sarasota: Sabal Palm led all banks in the region in percentage gain for non-interest income, up 489%. The bank had $430,000 in non-interest income in the second quarter, up from $73,000 in 2013. Sabal Palm CEO Neil McCurry says the increase was from a onetime gain in selling real estate on the bank's books.

USAmeriBank: At $5.6 million, the bank has the highest non-interest income in the region through the second quarter. But that's a 60.32% drop over 2013, when the bank had $14.3 million. President and CEO Joe Chillura says the loss is mostly attributable to the sale of an insurance firm the bank owned.