Our Founding Fathers were astonishingly capable of predicting man's weaknesses.

Their understanding of man's imbuement with the Seven Deadly Sins (lust, pride, envy, anger, greed, gluttony and laziness) ensured that a tough contract would have to be developed to control man's quest for power and wealth through government.

They built into the U.S. Constitution safeguards to keep government from getting too big, to prevent government from collecting enormous taxes and to keep man free from its shackles.

One of the most important safeguards involved was “honest money,” which they felt would be provided by Article 1, Section 8 of the Constitution, “requiring all debts, public and private, to be settled in gold or silver specie.”

Because debt had to be settled with something of real value, like gold and silver, when government ran up debts during war, they had to pay them back, under the terms that they were borrowed, after the war. Under this “new system” of ours today, government borrows whatever it wants and never repays a dime.

Creation of the dollar

Let's see if we can cover 300 years of economic history briefly enough to understand how we got into this terrible economic predicament with a worthless currency and why we must return to a gold and silver standard before this country can be free, again, from the shackles of government.

At the Constitutional Convention in 1787, one of the big arguments was over whether there should be a central bank. The Framers decided not to provide for a central bank because central banks had a history of destroying a country's currency.

Sir Isaac Newton set the price of gold at what became $20 an ounce in 1717, a value that lasted 200 years. His action was the result of the currency speculation that was occurring in France, which created the “Mississippi Bubble.”

France claimed the Mississippi Valley area in the early 1700s. To raise money for crown misadventures, mostly wars and lavish spending by nobility, France sold parts of the Mississippi Valley area to speculators who in turn sold the first “stocks” on a street corner in Paris to the public so they could participate in the expected “large future returns.”

Investors had wild dreams about rich resources from fur trading, minerals, farming and other endeavors. Stock prices became so unrealistic that they crashed, ruining the value of the French currency, because it was backed by so much debt.

This impressed upon our Founding Fathers the importance of limiting government's economic powers by insisting that all government contracts be settled in gold or silver specie.

After the war between France and Great Britain in the 1750s — over ownership rights of various parts of America — and before the Revolutionary War with England, France and Britain had gone broke fighting each other. England's King George III turned to the wealthiest people in his realm to tax, the colonists. Hence the tea tax and other taxes that led up to the Revolutionary War.

The signers of the Constitution were well aware of how government could destroy currency through war and debt unless government is mandated by law to pay back loans to the people from whom they borrowed money. Hence “all debts will be settled in gold or silver specie.”

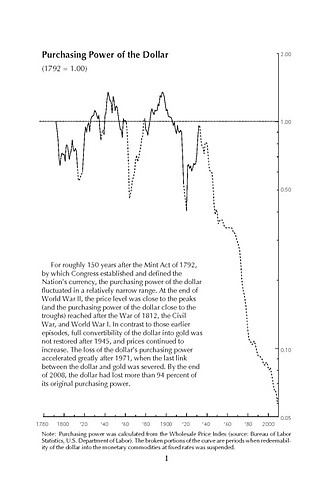

Finally, the Constitutional Convention came about as a result of the currency mess in the 13 colonies that existed after the Revolutionary War. The Continental dollar was worthless — “not worth a Continental.” The Currency Act of 1792 established the new nation's money and defined that currency, the dollar, in grains of gold. The dollar fluctuated in a narrow range, unchanged as valued in gold, until 1933.

Two epochal events

We now come to a year in our history that changed this country forever, provided for endless war, created capacity for bigger government and provided the vehicle for the destruction of our individual liberties.

That year was 1913.

The two most damaging events were the 16th Amendment to the Constitution, changing the language in the Constitution prohibiting a tax on income, and therefore, providing for the income tax.

The second was the creation, on Dec. 23, 1913, of the Federal Reserve System. The Federal Reserve Act provided for the issuing of currency, which previously, and constitutionally, is the job of the House of Representatives. The Founding Fathers knew that if there was a tax on income, and if there was a central bank, we would end up like the countless European countries in history where the government controls everything, and the people control little.

The income-tax amendment and Federal Reserve Act were sold to the people as “necessary.” Congressmen went home to their districts and said that they themselves were happy to pay 2% or 3% of their income to support the federal government, and they assured the public that nobody would be taxed more than 5% (and then only the wealthiest people).

Bankers and politicians sold the Federal Reserve System as something that would level out our recessions and be good for us, and they promised the centralization of power would be dispersed among 12 Federal Reserve Districts around the country. What they didn't tell everybody is that the government would control the process in concert with a handful of big, private banks.

Remember two things at this point: Gold was $20 an ounce in 1913, and today $1 purchases 1/50th of the goods and services that it did in 1913. Let's see what has happened:

• In 1917, gold could no longer be part of a bank's legal reserves, but rather, that gold had to be deposited with the Federal Reserve. This was the first big step in removing the public from the gold they had on deposit.

• On March 12, 1933, President Franklin Roosevelt, in his first Fireside Chat, assured the public that gold and silver coinage was not anymore important to own than a Federal Reserve note, because “the dollar was as good as gold.”

• Later on in 1933, the Roosevelt administration raised the price of gold to $20.67 an ounce, a 3.4% increase over $20 per ounce, by making it mandatory for citizens to turn in all of their gold in return for Federal Reserve Notes equaling $20.67 an ounce for every 1 ounce of gold redeemed.

What that really represented was a confiscation of privately owned specie wealth and the largest transfer of wealth to government from the private sector in history.

• In 1934, the Roosevelt administration increased the value of gold to $35 an ounce. That was a great deal: Buy something for $20.67 and revalue it to $35 a year later. One catch is that it did not benefit the U.S. citizen at all. It only benefitted the government because at that time government owned all of the gold through the Federal Reserve.

• The Bretton Woods System of 1944 essentially replaced gold as a standard of value in world markets with the dollar.

The U.S. had the power, and the gold in our vaults, at that time, and the rest of the world was in severe crisis. By way of the Truman and Marshall Plans after World War II, huge U.S. dollar currency reserves were built up by foreign countries. Soon, all international contracts, and all contracts for the purchase and sale of fossil fuels, were made in dollars.

When France tried to redeem their surplus of dollars for gold in 1971, President Richard Nixon closed the “gold window” and allowed gold to float freely from $35 an ounce. With Nixon shutting down the need for the U.S. to settle its debts in gold, the only thing then left to settle international debts with was dollars.

Paper replaces gold

There you have it. Government finally refused to settle debts in specie and was allowed to settle debts with paper.

From 1971 on, our national debt soared to where it is today, totally out of control, and on cruise control.

The power to make money by man, instead of through hard work, is a power men have sought for thousands of years.

Instead of gold that people tried to make chemically for centuries, our politicians did it with paper. They fly themselves back and forth to their homes in private jets at the taxpayers' expense. They have medical and retirement programs that are better than the ones that the government mandated for us.

Can we not get this message? Can we not understand that the government officials in this country are only serving themselves, and we who do not work for the government are paying them to have all this fun.

An economy built by debt will soon be destroyed by debt unless serious, mandatory measures are taken to: 1) quit further borrowing; and 2) invoke a plan to amortize the debt.

It's real simple, and we do not have a lot of additional choices. We must balance government spending with government income; reduce the size of our government; get it out of our lives; and take back our individual liberty — or this country will end up on a specie/barter system because the dollar will be totally worthless instead of worth 1/50th of what it was in 1913!

It is inconceivable that this could happen in the United States, but we are sitting on top of a powder keg. If it doesn't blow soon, it will certainly, within a few years.

Money control is people control. Governments control people through central banks, taxes on income and confiscation of real wealth like gold and silver.

We must wake up and reduce the size of government, get rid of a graduated income tax and dissolve the Federal Reserve System if we're serious about regaining our liberty and returning this country to greatness.

Caveat Emptor!

George Rauch is CEO of Bradenton-based General Propeller Corp. and a resident of Longboat Key.