Sour commercial real estate loans are turning into quicksand: Some banks on the Gulf Coast are being swallowed, while others are grasping for branches.

Out of a long list of quandaries facing Gulf Coast bankers, this could be the stickiest: To a man, bankers say the only way to climb out of the malaise caused by commercial real estate loan delinquencies is time.

Bank executives say they need time to work out new payment schedules, time to figure out a strategy for each delinquent commercial real estate loan and time to chase down capital to replenish loan loss reserves.

But time is in short supply these days, and therein lies the quandary.

Time is short, of course, because as many as a dozen banks on the Gulf Coast are under some sort of watch order from either a state or federal regulatory agency. Plus, several Gulf Coast banks show up as zero or one-star rated institutions on independent reports that probe data such as capital levels and asset quality — compilations which many bankers point to as an incomplete and unfair analysis.

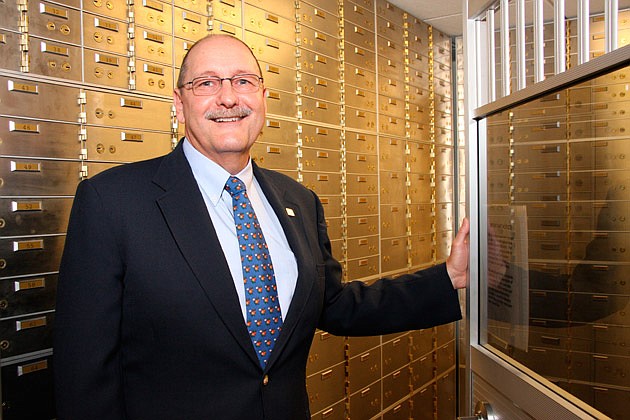

A prime example of the commercial real estate loan delinquency quandary can be found in the Fort Myers office of Hal Tate, who is president of Reliance Bank FSB. Reliance, a subsidiary of Frontenac, Mo.-based Reliance

Bancshares, opened a loan production facility in Lee County in 2004 to catch the boom. It opened its first full-service Fort Myers office in 2006 and moved into a new local corporate headquarters the next year.

Reliance isn't working under any regulatory orders and the bank's parent company had a healthy Tier 1 risk-based capital ratio of 10.61% as of June 30, according to Federal Deposit Insurance Corp. data. Nonetheless, Tate says

he would like nothing more than to shake “the dead weight” of commercial real estate delinquencies currently holding his bank hostage.

Indeed, at the end of June, 21.95% of Reliance's total portfolio of $20.25 million in commercial real estate loans were delinquent, a sum of $4.4 million. That 21.95% figure is the third highest of the 62 Gulf Coast-based community banks that reported any commercial real estate loan activity in the most recent quarter, according to an analysis of the region's banks compiled by Charlottesville, Va.-based research firm SNL Financial. (See related chart.)

“Obviously, getting that number down would be better for our overall health,” says Tate, who adds that Reliance's commercial delinquencies include everything from strip malls to raw land in failed development projects to office space.

“But we are in unchartered territory here,” Tate says. “We are trying to figure out the best way to work with borrowers.”

More pain

Tate has lots of company. According to the SNL analysis, as of the June 30 FDIC quarterly reports, there are 14 Gulf Coast-based banks with a delinquent commercial real estate loans rate of at least 10% — 16 banks if the tally includes the two lenders shuttered by regulators Aug. 7.

Nine of those banks have a delinquency percentage greater than 15% and three are above 20%.

Senior SNL product manager and analyst JP O'Sullivan says commercial real estate delinquency rates aren't necessarily a bulls eye regulators look for when gauging the health of a bank. It's not as crucial, for instance, as Tier 1 risk-based capital ratio or a bank's provisions for loan and lease losses.

But the commercial loan delinquency rate and how banks deal with it will assuredly play a key role in the industry's recovery, O'Sullivan and several other local bankers say.

Commercial real estate brokers will play a role, as they will be hired in the coming months and years to handle the sale and resale of properties. And the federal government will likely play a large role in the recovery as well, possibly through a program similar to the Resolution Trust Corp.

The federal government created the RTC in 1989 as a way to liquidate real estate assets that had once belonged to failed savings & loan associations. The RTC handled nearly $400 billion in assets over six years.

Mark Morris, president and chief executive of Fort Myers-based Commerce Bank of Southwest Florida says an RTC-like system “is probably the way to go.” Other bank executives on the Gulf Coast are lukewarm to the idea of yet another government program.

To be sure, banks themselves will take the brunt of the hit, in closures, mergers and millions of dollars in losses.

“A lot of banks made loans they shouldn't have made,” says O'Sullivan. “There has to be some pain for the people who made this happen.”

Under scrutiny

Still, when it comes strictly to commercial real estate loan delinquencies, there are several Gulf Coast-based banks that aren't in horrible shape.

In fact, as of June 30, 17 Gulf Coast banks had more than $100 million in commercial real estate loans on the books with a delinquency rate lower than 10%, according to the SNL analysis. Two of those banks, Fort Myers-based

IronStone and St. Petersburg-based Raymond James, are two of the largest banks on the Gulf Coast in terms of assets and deposits, yet have strikingly low commercial real estate delinquency rates.

Raymond James leads the way in that regard. The bank, with $8.4 billion in assets, had $3.126 billion in commercial real estate loans as of the most recent quarter. But only $8 million of those loans, or 0.26%, were delinquent — the best percentage of all Gulf Coast based banks.

Meanwhile, IronStone had a delinquency rate of 1.1%, or $13.7 million out of its $1.25 billion commercial loan portfolio, according to the SNL analysis.

But even a bank that scored well in SNL's commercial loan delinquency analysis could still be in danger when it comes to an institution's overall financial health. IronStone, for example, lost $7 million in the second quarter.

There's also Naples-based Orion Bank and TIB Bank, a subsidiary of TIB Financial Corp. Both of those banks had more than $500 million in commercial real estate loans as of June 30, according to SNL, yet had delinquency rates of less than 5%. In fact, TIB had a delinquency rate of just 4.02%, or $23.8 million out of $592 million in total loans.

Still, both Orion and TIB are working under the scrutiny of some type of regulatory agreement. And Orion lost $10 million in the second quarter, according to FDIC reports, while TIB lost $3.7 million.

'Big drivers'

The challenges posed by commercial real estate delinquencies stretch well past the Gulf Coast. FDIC chairwoman Sheila Bair, in an Aug. 27 press statement concerning banks' second quarter earnings reports, called clean up of the problem “difficult and necessary.”

Says Bair: “Deteriorating loan quality is having the greatest impact on industry earnings, as insured institutions continue to set aside reserves to cover loan losses. [And] the amount that insured institutions added to their reserves for loan losses was, by far, the largest drag on industry earnings compared to a year ago.”

In an interview a few days later on CNBC, Bair also said that commercial loans “are likely to be the biggest drivers of future bank failures.”

SunTrust Banks CEO James Wells III, speaking in Atlanta a few days before Bair made her comments, also had a negative outlook concerning commercial real estate loans. “The industry is a long way from declaring any sort of victory, especially regarding credit issues,” says Wells. “We do not expect things to improve for the banking industry in the very near future.”

Atlanta-based SunTrust had $15.9 billion in commercial real-estate loans as of June 30, or 13% of its total $122.8 billion loan portfolio, according to Bloomberg News. The bank, one of the largest regional lenders on the Gulf Coast, wasn't receiving interest on less than 1% of its commercial real-estate loans.

Out of a long list of quandaries facing Gulf Coast bankers, this could be the stickiest: To a man, bankers say the only way to climb out of the malaise caused by commercial real estate loan delinquencies is time.

Bank executives say they need time to work out new payment schedules, time to figure out a strategy for each delinquent commercial real estate loan and time to chase down capital to replenish loan loss reserves.

But time is in short supply these days, and therein lies the quandary.

Time is short, of course, because as many as a dozen banks on the Gulf Coast are under some sort of watch order from either a state or federal regulatory agency. Plus, several Gulf Coast banks show up as zero or one-star rated institutions on independent reports that probe data such as capital levels and asset quality — compilations which many bankers point to as an incomplete and unfair analysis.

A prime example of the commercial real estate loan delinquency quandary can be found in the Fort Myers office of Hal Tate, who is president of Reliance Bank FSB. Reliance, a subsidiary of Frontenac, Mo.-based Reliance Bancshares, opened a loan production facility in Lee County in 2004 to catch the boom. It opened its first full-service Fort Myers office in 2006 and moved into a new local corporate headquarters the next year.

Reliance isn't working under any regulatory orders and the bank's parent company had a healthy Tier 1 risk-based capital ratio of 10.61% as of June 30, according to Federal Deposit Insurance Corp. data. Nonetheless, Tate says he would like nothing more than to shake “the dead weight” of commercial real estate delinquencies currently holding his bank hostage.

Indeed, at the end of June, 21.95% of Reliance's total portfolio of $20.25 million in commercial real estate loans were delinquent, a sum of $4.4 million. That 21.95% figure is the third highest of the 62 Gulf Coast-based community banks that reported any commercial real estate loan activity in the most recent quarter, according to an analysis of the region's banks compiled by Charlottesville, Va.-based research firm SNL Financial. (See related chart.)

“Obviously, getting that number down would be better for our overall health,” says Tate, who adds that Reliance's commercial delinquencies include everything from strip malls to raw land in failed development projects to office space.

“But we are in unchartered territory here,” Tate says. “We are trying to figure out the best way to work with borrowers.”

More pain

Tate has lots of company. According to the SNL analysis, as of the June 30 FDIC quarterly reports, there are 14 Gulf Coast-based banks with a delinquent commercial real estate loans rate of at least 10% — 16 banks if the tally includes the two lenders shuttered by regulators Aug. 7.

Nine of those banks have a delinquency percentage greater than 15% and three are above 20%.

Senior SNL product manager and analyst JP O'Sullivan says commercial real estate delinquency rates aren't necessarily a bulls eye regulators look for when gauging the health of a bank. It's not as crucial, for instance, as Tier 1 risk-based capital ratio or a bank's provisions for loan and lease losses.

But the commercial loan delinquency rate and how banks deal with it will assuredly play a key role in the industry's recovery, O'Sullivan and several other local bankers say.

Commercial real estate brokers will play a role, as they will be hired in the coming months and years to handle the sale and resale of properties. And the federal government will likely play a large role in the recovery as well, possibly through a program similar to the Resolution Trust Corp.

The federal government created the RTC in 1989 as a way to liquidate real estate assets that had once belonged to failed savings & loan associations. The RTC handled nearly $400 billion in assets over six years.

Mark Morris, president and chief executive of Fort Myers-based Commerce Bank of Southwest Florida says an RTC-like system “is probably the way to go.” Other bank executives on the Gulf Coast are lukewarm to the idea of yet another government program.

To be sure, banks themselves will take the brunt of the hit, in closures, mergers and millions of dollars in losses.

“A lot of banks made loans they shouldn't have made,” says O'Sullivan. “There has to be some pain for the people who made this happen.”

Under scrutiny

Still, when it comes strictly to commercial real estate loan delinquencies, there are several Gulf Coast-based banks that aren't in horrible shape.

In fact, as of June 30, 17 Gulf Coast banks had more than $100 million in commercial real estate loans on the books with a delinquency rate lower than 10%, according to the SNL analysis. Two of those banks, Fort Myers-based

IronStone and St. Petersburg-based Raymond James, are two of the largest banks on the Gulf Coast in terms of assets and deposits, yet have strikingly low commercial real estate delinquency rates.

Raymond James leads the way in that regard. The bank, with $8.4 billion in assets, had $3.126 billion in commercial real estate loans as of the most recent quarter. But only $8 million of those loans, or 0.26%, were delinquent — the best percentage of all Gulf Coast based banks.

Meanwhile, IronStone had a delinquency rate of 1.1%, or $13.7 million out of its $1.25 billion commercial loan portfolio, according to the SNL analysis.

But even a bank that scored well in SNL's commercial loan delinquency analysis could still be in danger when it comes to an institution's overall financial health. IronStone, for example, lost $7 million in the second quarter.

There's also Naples-based Orion Bank and TIB Bank, a subsidiary of TIB Financial Corp. Both of those banks had more than $500 million in commercial real estate loans as of June 30, according to SNL, yet had delinquency rates of less than 5%. In fact, TIB had a delinquency rate of just 4.02%, or $23.8 million out of $592 million in total loans.

Still, both Orion and TIB are working under the scrutiny of some type of regulatory agreement. And Orion lost $10 million in the second quarter, according to FDIC reports, while TIB lost $3.7 million.

'Big drivers'

The challenges posed by commercial real estate delinquencies stretch well past the Gulf Coast. FDIC chairwoman Sheila Bair, in an Aug. 27 press statement concerning banks' second quarter earnings reports, called clean up of the problem “difficult and necessary.”

Says Bair: “Deteriorating loan quality is having the greatest impact on industry earnings, as insured institutions continue to set aside reserves to cover loan losses. [And] the amount that insured institutions added to their reserves for loan losses was, by far, the largest drag on industry earnings compared to a year ago.”

In an interview a few days later on CNBC, Bair also said that commercial loans “are likely to be the biggest drivers of future bank failures.”

SunTrust Banks CEO James Wells III, speaking in Atlanta a few days before Bair made her comments, also had a negative outlook concerning commercial real estate loans. “The industry is a long way from declaring any sort of victory, especially regarding credit issues,” says Wells. “We do not expect things to improve for the banking industry in the very near future.”

Atlanta-based SunTrust had $15.9 billion in commercial real-estate loans as of June 30, or 13% of its total $122.8 billion loan portfolio, according to Bloomberg News. The bank, one of the largest regional lenders on the Gulf Coast, wasn't receiving interest on less than 1% of its commercial real-estate loans.

(Bloomberg News contributed to this story.)