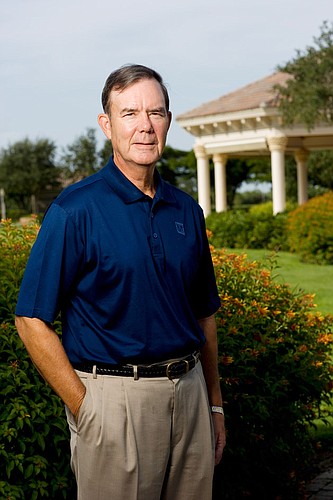

Bonita Bay Group Chairman David Lucas discusses the outlook for the residential development company and how it plans to emerge from the real estate downturn.

David Lucas isn't a banker, but he now knows what it feels like to experience a run on deposits.

The chairman of the Bonita Bay Group, one of the Gulf Coast's most successful developers, has received a flood of redemption requests recently from residents who want out of the seven clubs in its communities.

Unlike most residential-community clubs, Bonita Bay Group's policy was to refund the deposits of any member who resigned, without restrictions. The developer refunded $77 million to golf-club members who resigned between Jan. 1, 2005, and Nov. 7, 2008.

But in November, the company suspended the refunds because of the deteriorating economy and the company's dwindling resources. Bonita Bay Group's club liability is enormous: Membership deposits net of refunds total $243.2 million. Of that total, $18.9 million is now on the waiting list for refunds. Meanwhile, land sales fell from more than $90 million in 2006 to a forecasted $2.2 million in 2009, a stunning 97% drop.

With land sales anemic and the prospects for a recovery at least a year away, Bonita Bay Group is seeking to sell the clubs to its members to avoid bankruptcy reorganization. Chief Restructuring Officer Tim Boates joined the company to oversee the sale of the clubs.

The privately held company isn't used to bad publicity. David Shakarian, the founder and chairman of General Nutrition Corp. (GNC), assembled the land for the first community in Bonita Springs in 1980. Since then, the Bonita Bay Group has been at the forefront of eco-friendly development, working with environmentalists to design lushly landscaped communities that have won widespread accolades among peers. The company is still owned by Shakarian's heirs, including son-in-law and chairman David Lucas.

Lucas recently sat down with the Review to discuss the company's perspective and outlook. Here is an account, edited for style and length:

Let's say the club issue is resolved, what will Bonita Bay Group look like?

It's a smaller, more agile organization. It's still a developer. We're still committed to doing a quality job. But I think we'll have a tighter organization with fewer employees. The clubs are the vast majority of our employees. So if we don't have the clubs, that whole superstructure is gone. We'll rely more on consultants and contractors than we will on rebuilding our staff to the point where it was three or four years ago. So I would see us as a smaller, more nimble organization, still committed to quality.

If you could do it over, what would you have done differently?

First thing we did was we didn't anticipate the depth and the length of this recession. In 2005, I saw it coming and we sold some property. So I was smart enough to do that. But then in 2006, I bought a significant amount of property and that turned out to be the wrong thing to do. We increased our leverage and, in hindsight, it's not what we should have done.

Why did you buy land in 2006?

We viewed it at the time as a buying opportunity. We had several pieces that we were trying to get our hands on that people wouldn't sell to us. And then when it softened up a little bit, those people came back and said now we're interested. So we thought, terrific, this is a great opportunity for us. I don't think anybody anticipated that business was going to be bad for four years. Business stopped in October 2005 when the hurricane hit. That was Wilma. We haven't seen good business since then. It's pretty hard to hold it all together if your sales are down for four years.

How does any business survive a downturn of this magnitude?

We basically reinvested our profits back into the business to grow, so we were on a growth strategy. And that worked great for the first 21 years of the company. Our sales went from $4.5 million in 1985 to $431 million in 2005.

(The 2005 figure includes $150 million of bulk sales.) We did $2.1 billion in sales and had pretax profits of $221 million from 1985 through 2006. And the last three years, between 2007, 2008 and 2009, will wipe that out.

What are the prospects now for lot sales?

Eventually they're going to be just fine. The question is how long it's going to take for that to happen. My own view is that we probably have another year of substandard business conditions.

What needs to happen in the economy for things to turn around?

The thing that's still a problem in the economy is the credit system. I don't think the banks, in general, have solved their problems and I don't think they're lending on a normal basis. Until that frees up, I don't think things are going to get truly better. The whole banking system is really a key to the economy. And if it's not working correctly, then I don't think the economy can work at full efficiency.

How much does the Bonita Bay Group owe you and your family?

The family has related-party notes. Those notes would be paid back to the family as repayment of debt as opposed to an equity distribution. It's in excess of $115 million.

And the lender group, led by KeyBank, how much are they owed?

$74.5 million.

Can your family write a check and get rid of the club-refund problem that way?

The short answer is I can't write a $245 million check.

How about an $18 million check to cover the current redemption requests?

The problem is we've already put $115 million into the business. And that's in addition to earlier cash contributions. At some point in time, you have to look at your remaining assets in relation to the potential liability. You have to say at some point enough is enough.

If you could go back in time, would you have changed the club-deposit refund policy?

Yes. It would have been more conventional.

In retrospect would you have set aside more reserves?

I would have used less leverage.

Your developer neighbor down the road, WCI Communities, filed for bankruptcy reorganization as a way to get through this. Are there any benefits for the Bonita Bay Group filing for reorganization?

The advantage is the debt holders have to get in line. The unsecured creditors, if there's no money left, they're out of luck. The disadvantage is we get wiped out, too. At this point in time we're trying to avoid bankruptcy because we think there's value in the company after we pay off the debts.

At some point you changed lenders, right?

Yes, we changed from SunTrust to KeyBank. It was Nov. 7, 2007.

Did you have to personally guarantee that bank debt?

No.

How is your relationship with KeyBank? They probably don't want to be landowners.

No lender wants to take the land back, so you're right. They want to work with us and we want to work with them. I wouldn't characterize it as being a real adversarial situation. We both know we have a common goal, which is to get the debt paid off. It's been a professional relationship.

You got an extension on the KeyBank debt recently. Can you give us a little more detail about the terms of the extension?

What happened was we had a $30 million letter of credit at Citibank that was available for the bank to draw on. We wanted to use that money to continue the operations of the business, for working capital, because it was our money. It was $30 million that the family put up. It was a $30 million letter of credit. The bank wanted to use the money to pay down the debt. So we had a disagreement and we negotiated it out and split the difference. So we have money now to run the business and paid down the debt to a certain extent. That's how we worked it out.

How much time does the extension give you?

A year.

So you have breathing room for a year?

Based on where we are with our plan, I think we'll be able to handle north of a year. We're on a very strict budget that we are meeting at this time.

How much community development district debt has Bonita Bay Group issued and how much is outstanding?

We've issued $189 million. I think there's $44 million outstanding.

Those debt payments are on schedule?

They're on schedule.

You don't anticipate any issues with those?

It's a point of negotiation with the clubs now in terms of how that's handled going forward. But we're current on all that debt.

What are the prospects for some of the other projects you have on the drawing boards, like Eastwood Village in Fort Myers, North River Village in Lee County and the land in Hendry County?

They're sort of in hibernation right now. We don't foresee starting up any new projects until the economy firms up.

Have you considered selling the company?

Yes, it's an option, but it's not something we're actively pursuing. I guess if somebody came along and made me an offer I couldn't refuse, I would do it. But our plans are to continue as a family-owned company.

Have you had any investors approach you about that?

Yes.

Were they serious buyers or bottom fishers?

Probably a combination of both.

Were they private equity?

There's only been less than a handful. A couple of them were investors and one of them was an operator.

You've built your brand over time with a sterling reputation. But the last three months, the negative publicity seems to have hurt land sales.

I think the land sales are a function of uncertainty plus economic conditions. Nobody's doing much business right now. So I don't think that's necessarily a reputation thing. I would agree with you that we've taken some hits. I think a lot of the noise that's being generated is coming from a fairly small number of people who are very dissatisfied. I don't think that reflects the feeling of the vast majority of residents. But it has been a troublesome situation.

Boates has done a good job. He's there to be a negotiator and he's a tough negotiator. But I think he's fair. He's made considerable progress with all the clubs.

Your company has been so articulate and open in the past, but there's been a cone of silence for the last three or four months while negotiating with club members. Why?

At first we didn't realize how big a [public-relations] problem it was going to become. We didn't think it merited a response because it wasn't significant enough. We thought this is going to go away. This is what I'm trying to do now is to try and get our side of the story out. This isn't what we want to spend our time on. We underestimated the impact that these people were going to have.

Who are your auditors?

Grant Thornton is our auditor now. And Deloitte & Touche was our auditor for many years before that. We've been with Grant Thornton for two or three years now.

How did your auditors view the issue of deposits on the clubs? Did they have any issue with how you were accounting for those?

They never questioned the financial treatment we had. It's pretty well settled that with these equity convertible clubs that you count the deposits on your balance sheet as a liability. You don't recognize the income until the club has been turned over. That's settled accounting.

Should you have to set up reserves for that liability?

No. The club members are unsecured creditors.

Was the hiring of Tim Boates a joint decision?

Yes.

How long will Tim Boates be with the Bonita Bay Group?

Right now his main focus is the clubs. I don't know how long he's going to be here, but it's going to be a matter of months, not years.

Then will you appoint a new chief executive?

It's funny you ask that. We were just talking about that yesterday. We're still in the process of looking at that.

How do you attract a chief executive in this environment?

I think there are a lot of good people out there who are looking for a challenge.