REVIEW SUMMARY

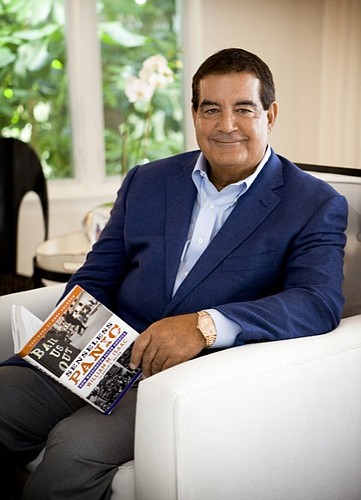

Individual. Bill Isaac, former chairman of the FDIC

Industry. Banking, financial

Key. Isaac's new book probes mistakes made by politicians in both parties to quell financial issues in late 2008 and early 2009.

Bill Isaac, the nation's top banking regulator during the savings-and-loan crisis in the 1980s, received an urgent text message one day in the fall of 2008.

The text came from the chief executive of one of the largest banks in the country, who reached out to Isaac while Isaac sat in the office of his waterfront Lido Shores home just south of Longboat Key. Isaac, chairman of the Federal Deposit Insurance Corp. from 1981 to 1985, still worked in the industry but was semi-retired.

The text was blunt. “You won't believe what they are making us do,” Isaac recalls his friend wrote.

The “they” was the federal government, then led by Treasury Secretary Hank Paulson. According to the banker in the room in Washington, Paulson officially told the nine largest banks in the country that taking money from the Troubled Asset Relief Program was no longer an option.

It was a done deal. Those banks, including industry behemoths Bank of America and Wells Fargo, would be given a combined $750 billion. The supposed purpose for the bailouts was for the government to buy the bank's toxic assets.

Isaac shuddered. He considered TARP to be a colossal mistake. Just a few weeks before Isaac got that text, in fact, he wrote a column for the Washington Post, where he said it was “far from clear that the plan is necessary or will accomplish its objectives.

“It's worth recalling that our country dealt with far more credit problems in the 1980s in a far harsher economic environment than it faces today,” Isaac wrote in the Sept. 27, 2008, column. “About 3,000 bank and thrift failures were handled without producing depositor panics and massive instability in the financial system.”

Compare that to today: Since the recession began, less than 300 banks have failed. Hardly a crisis in comparison.

As it turned out, TARP was only the first step of what Isaac considers a long run of mistakes enacted by Washington politicians. He recently wrote a book on just that topic, “Senseless Panic: How Washington Failed America.” And since TARP and his column in the Washington Post, Isaac has testified before Congress on the issue numerous times and has made dozens of speeches and television appearances on the topic.

“I believe the government has lost our trust,” Isaac told the Business Review in a recent interview. “The majority of the institutions have lost our trust. We've lost faith in our political leadership.”

Isaac is a reluctant warrior. He nearly balked at his first congressional testimony opportunity so he could go to a Tampa Bay Buccaneers game with his family. But his wife talked him into going to Washington to follow his passion.

“I was angry and frustrated,” says Isaac. “I was clinging to the belief that there was a better way to do things.”

TARP wasn't the only thing that caused the current economic pain, either. Isaac says it was actually two decades of bad economic policy, horrible crisis management, with TARP and the succeeding Washington interventions that did it.

And now, to exacerbate the situation, Isaac, in his book, wrote: “Our leaders are trying to deflect blame to 'greedy bankers,' and are offering slogans rather than solutions.”

Powerful forces

One of the remarkable aspects to the 2008-2010 financial crisis was that almost no one in the upper levels of the Bush or Obama White Houses tapped Isaac's firsthand experience with the FDIC.

President Jimmy Carter appointed Isaac to the FDIC in 1978, when the banker was just 34 years old. By 1981 he became chairman.

Isaac's appointment coincided with the onset of the savings-and-loan crisis, which ultimately ensnared 3,000 banks and thrifts over a decade. The failures included Continental Illinois, which was then the seventh-largest bank in the country. In total, says Isaac, the failures cost the FDIC more than $100 billion.

Isaac essentially dealt with two powerful forces in his time in charge. On the one hand, he had to deal with closing banks and the aftermath of the decisions. He did that against the backdrop of an economy marked by a prime rate of 21.5% and at least an 11% unemployment rate.

The effort involved a lot of weekend work and sleeping on his office couch, he wrote in his book. Isaac, however, realized early on in his tenure he had to try to alter the way the Congress, the American public and the banks themselves thought about the FDIC and what it was supposed to do.

Up until then, the FDIC was more of an afterthought. It looked over some small state banks and oversaw only a handful of failures a year.

But Isaac argued then, like he does today, that the FDIC should do more because it's supposed to be an independent agency free from being controlled by the Treasury or any other department subject to political winds.

Indeed, a key point Isaac makes in his book and on TV interviews is that the current mess of financial problems could have been avoided — or at least mitigated — if independent agencies weren't influenced by political machinations.

“The 1980s crisis was handled by the FDIC and the Fed,” Isaac says. “Those were two independent agencies that didn't have to beg for money or play politics.”

Hope remains

Isaac's shift in thinking about the FDIC, however, didn't have much long-term impact. Isaac says the current financial debacle proves that.

“The panic of 2008 absolutely should not have happened,” Isaac wrote in his book. “Its seeds were sown by our failure to understand the lessons of the 1980s and our misguided responses to that crisis.”

The misguided responses began with Paulson, who Isaac says was arrogant and over his head. It carried through to the Wall Street reform bill sponsored by Sen. Chris Dodd and Rep. Barney Frank. Isaac is unequivocal about the new legislation:

“This Dodd-Frank bill is a horrible disaster,” he says. “It doesn't fix any of the current problems, and it doesn't prevent any future crises.”

Instead of Dodd-Frank, which he calls “2,300 pages of increased regulatory legislation that serves no purpose,” to fix the banking system, Isaac recommends the federal government:

• Enact legislation to rein in Fannie Mae and Freddie Mac. Isaac wrote that “Freddie and Fannie played a very major role in creating the financial mess in which we found ourselves in 2008.” The only way to control that, he says, is to pass a bill that limits the agencies' liability;

• Consolidate bank supervision from the myriad of agencies and departments that currently do it to one office, the Financial Institutions Regulatory Authority;

• Eliminate procyclical rules, especially mark-to-market accounting, which “inflate earnings and capital in good times and senselessly destroy earnings and capital when the markets head south,” Isaac wrote. The rules, according to Isaac, also make it difficult for banks to build loan loss reserves in good times, which he says is the best time to do it;

• Increase capital requirements, especially for the largest banks, which Isaac says will help banks withstand problems that come up. In the process, says Isaac, that move could repair some of the damage caused by international capital accords that supposedly put U.S. banks on even terms with banks in foreign nations. Those kinds of formulas, says Isaac, “rely on mathematical models that aren't tested and are backward-looking. It is highly cyclical and it exacerbates the problems.”

These changes are not high on Democratic lawmakers' agendas. Which leaves Isaac not feeling upbeat about what's ahead.

“I'm an optimist, but it's hard for me to be optimistic right now,” Isaac says. “We don't have a lot of dry powder. Interest rates are already near zero. We're $13 trillion in debt.” The old Keynesian economic tricks aren't working, never have.

“The thing I take comfort in,” Isaac says, “is that we've been through hard times before and built a better life for our children. I take comfort in that the people of this country have a limited amount of patience. I want to see a lot of incumbents gone.”

Busy Bill

Sarasota resident Bill Isaac won't spend too much time at home this fall.

The former chairman of the Federal Deposit Insurance Corp. will instead be globetrotting, from Melbourne and Sydney, Australia, to New York City (twice) to Cincinnati and Columbus, Ohio. He will be going to those places and to other locales to promote his new book, “Senseless Panic: How Washington Failed America,” and his calls for different banking reform.

Isaac has several other jobs. For one, he is chairman of the board of Cincinnati-based Fifth Third Bank, a role he was appointed to in May. Isaac is also a partner in Pineapple Square, a $200 million redevelopment project in downtown Sarasota going through some market dictated changes.

For a time, Isaac also was part of a group of former banking executives and regulators who planned to buy failed banks from the FDIC. That effort is now on hold. “I am not actively involved in bank acquisitions at this point other than in a consulting capacity,” Isaac says.